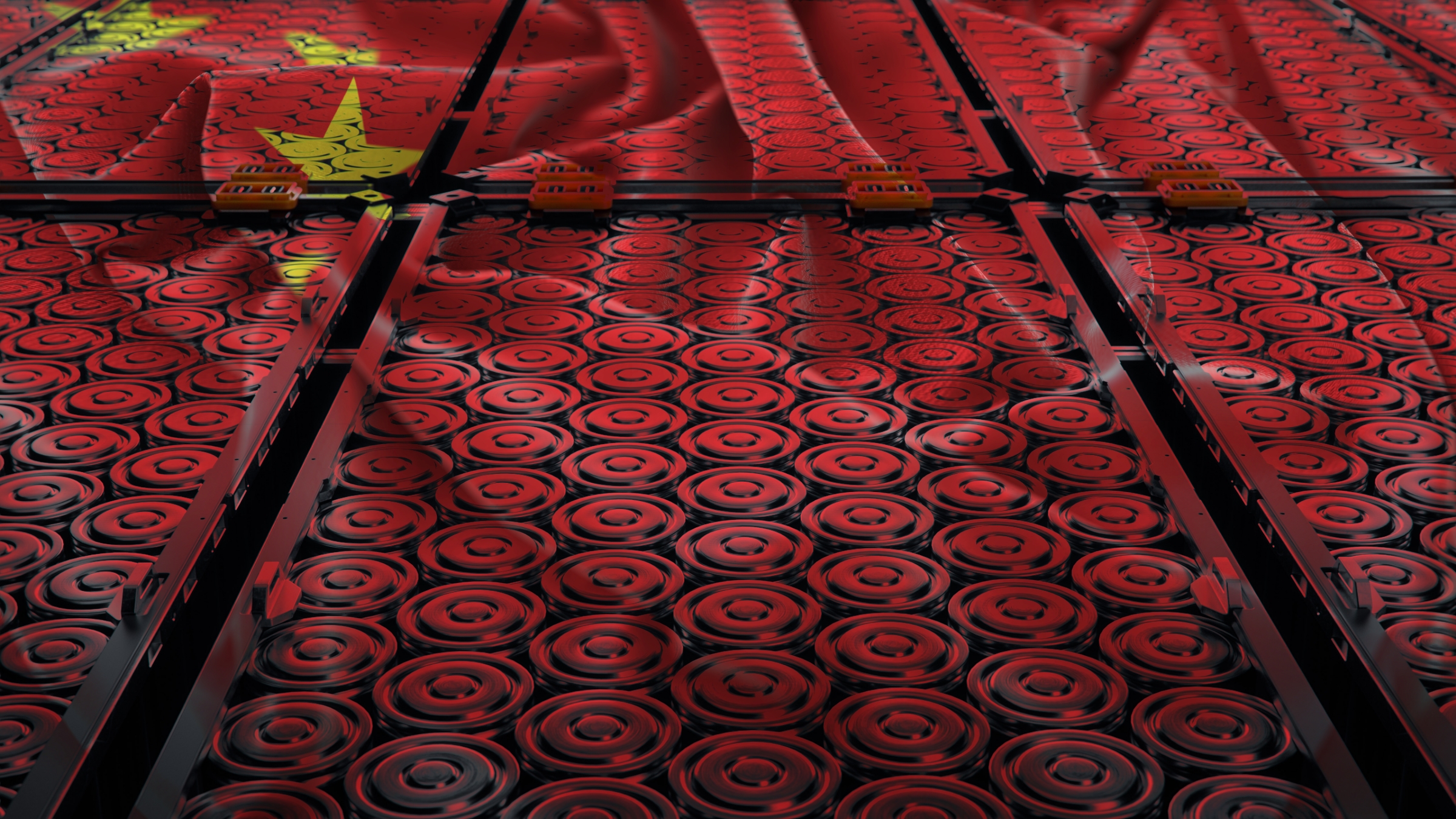

China will now require government licenses to export key electric vehicles (EV) battery technologies, guarding innovations like CATL’s 5-minute-charge lithium cells, threatening to slow Western efforts to build independent supply chains for EV battery solutions, according to The New York Times.

The restrictions, announced alongside rare-earth export curbs, will consolidate Beijing’s lead in low-cost, high-performance batteries, while simultaneously, complicating plans for Chinese EV battery manufacturing plants in US-based Michigan and EU-backed factories.

Beijing’s making it very clear for the Western powers that as CATL and BYD dominate a consolidating market, the world’s second-largest economy is now using EV technology as a geopolitical leverage.

The governmental licensing will force automakers to choose between Chinese partnerships or face costly homegrown alternatives.

Chinese Battery Industry Faces Consolidation Wave

China’s EV battery safety standards have transformed dramatically in five years, with new and cheaper high-performance batteries, making EV battery manufacturers in China produce less expensive products compared to Western counterparts.

The hyper-competitive industry now stands face-to-face with consolidation.

With fierce competition and thinning margins, smaller battery manufacturers are being acquired or forced out by giants, like CATL and BYD in Shenzhen. By controlling critical battery technologies’ exports, Beijing shields these national champions from foreign replication, guaranteeing China remains the global and main center of lithium-ion and LFP battery innovation.

Power Balance Dramatically Transformed

This is economic protection is a strategic shift in technology of EV battery manufacturers in China. By protecting the low-cost EV technologies, China is showing that it sees electric vehicles not only as consumer products, but Beijing is also now a leading technology to secure long-term industrial and political power.

Beijing’s decision coincides with mushrooming China-West tensions over EV battery solutions.

Earlier this year, Beijing added export licenses for seven rare earth minerals and magnets – essential for automotive motors, robotics, and electronics – disrupting manufacturers in the US, Europe, and Japan.

The latest EV battery supply chain restrictions further establish China’s position at the heart of the global electric vehicle ecosystem. As Western nations seek to develop their own supply chains and reduce dependence on China, these new licensing rules raise questions about how quickly and at what cost they can catch up with China.

As global demand on EV battery swapping and having China being at the top of the list will cause geopolitical tensions. This makes one question whether or not Trump will impose tariffs down the road. As it’s a disorder that the US government faces, which is not being able to stand the idea of having a country accelerate in an area more than it can.

This shift in EV battery solutions would redefine world trade, include new investment and force auto makers to rethink their strategy in a world where China possesses not only the manufacturing lead it has the keys to mobility’s future.

Inside Telecom provides you with an extensive list of content covering all aspects of the tech industry. Keep an eye on our Tech sections to stay informed and up-to-date with our daily articles.