Discover the insights from an exclusive interview with Dr. Cesar Jabr, Deputy CEO of Monty Holding, at the Seamless 2023 event in Dubai. This article delves into the transformative power of fintech and the evolving Middle East market. Dr. Jabr discusses the shift towards user-centric technology and its impact on traditional banking systems. Moreover, he highlights the crucial role Monty Holding plays in driving financial inclusion in emerging countries, empowering individuals through education, awareness, and mobile-first platforms.

I haven’t read the reviews about this year’s Seamless event in Dubai.

I didn’t have to, I was there, and I witnessed the success of this annual tech get-together firsthand. It was a fascinating exhibition of current and future tech, and how to access it. I spoke with many technologists, futurists and business leaders, gaining insight after insight after insight.

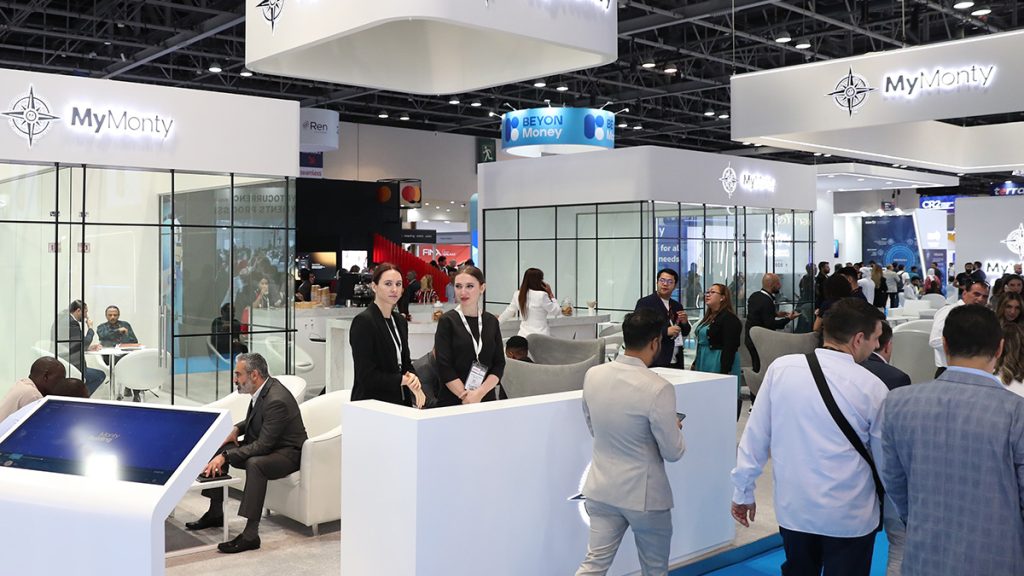

The presence of one particular exhibitor was of particular interest to me, although my use of the word ‘one’ here is a little misleading, as I found myself drawn into a fascinating chat about fintech, developing markets and network equipment. All of which fall under the banner of the Monty stable of companies. In the instance of this event, MyMonty and MontyPay. And the man I spoke to was none other than the Deputy CEO of Monty Holding, Dr. Cesar Jabr.

The first topic was fintech and I asked him about changes in the Middle East fintech market.

“Well, it’s interesting. Initially, we may have been skeptical or surprised by the changes. However, as we assessed the market’s readiness and maturity, we realized there was a significant shift,” he initiated the conversation.

“In previous Seamless editions, we started by meeting only with suppliers and gradually began interacting with most. Seamless transitioned from offering traditional point-of-sale machines to selling advanced biometric recognition tools and solutions, prioritizing security. This year, we observed a focus on these same aspects simultaneously with artificial intelligence tools and solutions; only this time, we became more optimistic because we had much more leads than in the previous editions.

We believe that the digital revolution, driven by artificial intelligence, is making a real impact on the masses. As a result, traditional banks are becoming more discerning and actively seeking upgrades,” Dr. Jabr expressed.

“But what’s driving the changes?”

“In the context of financial inclusion in emerging countries, the key factor driving progress is technology development. Everything revolves around the user experience and journey. The company’s significance diminishes, as does the importance of the bank. Ultimately, it is the user who determines the fate of both the company and the industry.

This realization has recently become more widespread. I believe the underlying theme is empowering consumers to shape a new generation of adaptable baking solutions that answer their specific circumstances.

Moreover, this trend also aids economically disadvantaged countries. For example, we are now witnessing the emergence of more African and emerging countries companies, even from those traditionally considered poor and underbanked. This is a directed representation of the rise of financial inclusion in emerging countries,” he added.

I leapt on this last ever-contentious issue.

“Tell me about the company’s view of the underserved.”

Cesar responds. “I believe that we have a crucial role to play in enabling financial inclusion in emerging countries in Africa. Our aim is to essentially become the driving force behind financial inclusion in emerging countries and in these regions.

Education and awareness play a pivotal role in this endeavor. It is important to note that it is not only the utilization of fintech services; our focus is on empowering individuals by providing them with the means to have a say in the road of progress toward digital success level. The impact we can create is a result of collaboration with different stakeholders in separate areas from combined angles.

The journey begins with a small step, often located in the top right corner of the picture. Additionally, our banking partners play a crucial role in providing instant support through our own fintech solutions.

You have to remember that advancements in technology have revolutionized the way we access financial services. It’s no longer necessary to physically visit multiple locations for various transactions. With just one tap on your mobile device, you have access to everything you need. You can conduct transactions, make payments, and finalize all your financial activities seamlessly. The key to this convenience lies in a robust network that connects all these transactions.”

I mention that I’ve talked to some companies at Seamless who are promoting current digital services in African countries with legacy networks.

“This seems contradictory, no?”

“Not really”, continues Cesar. “Our approach is mobile-first. We understand the importance of optimizing our platform for mobile devices. Nowadays, consumers are increasingly reliant on their mobile devices to search for products and services.

For example, when a fish merchant wants to reach potential customers, the merchant will need to be assured that they have strong mobile connectivity. Platforms like eBay serve as a popular destination where users can easily access a wide range of marketplace products, including fish.

By leveraging mobile technology, fish merchants can connect directly with consumers, eliminating the need for intermediaries who may have set their priorities ahead of the users’. This aligns with the expectations of people who often face challenges due to over-promising or lack of access to desired products. Our goal is to enable these mobile platforms, not just for buying and transferring funds but also to provide a seamless, frictionless payment experience. This way, users can conveniently find and engage with our bank without the hassle of searching for alternatives or flipping through various options or mobile applications.”

“A bank in your pocket, so to speak?” I ventured.

“Absolutely. Our platform empowers users to take charge of their financial activities, fostering financial inclusion in emerging countries. As a user, you have the ability to control and manage every aspect of your finances, rather than relying solely on the bank. By shifting this power to the users, we are putting the control in the hands of the people and reducing the stronghold of the traditional banking system. It’s a paradigm shift that enables individuals to have greater autonomy and freedom when it comes to their financial decisions.”

“What are the new products you’re promoting this year that you didn’t have last year?”

“Okay, so in terms of our evolution since last year, MontyPay has gained more presence with expanded licenses and is now live in Jordan, and we’re planning for more geographic expansion and more industry verticals to serve.

Specifically, Jordan, KSA, Nigeria, and Lebanon are the four major targeted countries. The next target is the Philippines. We are experiencing growth in terms of partnerships and customer base,” Cesar carried on.

“In the MyMonty area, we have two key aspects: partnership and our core banking system. We have developed a minimal viable product (MVP), which we refer to as a wallet, that is ready to be sold as software as a service (#SaaS). This is a new offering for us, as our previous focus was BtoC, meaning customers would use MyMonty as a brand, either through our technology or the partners’. However, now we have developed our own technology and are ready to provide it.

Another expansion opportunity is in embedded finance #EmFi, which involves providing solutions to non-financial companies. For example, Uber is an embedded finance company as it offers taxi services but also has a financial layer. Our solution is well-suited for this vertical. Additionally, we offer banking as a service #BaaS, enabling banks to onboard other neo banks.”

“What does this mean for MyMonty?”

“This means we can go into a country and have four different partners. Before, we could sell to only one because the next would have to force a differentiation. And the beauty is, we don’t have to own a license. We work under the license of partner banks. Our model is, like Revolut’s and the other neo major neo banks, we only obtain a license once we test the market, the market is growing, and the financial license is useful for us. Because it takes one year to have a license issued and we can’t afford to wait. So, we start under the umbrella of a licensed partner. And if our partners are happy with us, they will do everything for us to stay with them.”

“What’s new in this year of Seamless 2023 for MyMonty and MontyPay?”

“When we first came, pre-COVID, it was just an idea whether we do fintech or not. We took a booth and then we started getting involved at the bigger booths each time. This time we have two booths, two large ones. So, from that, we see that now the crowd has also evolved, not only us. First, we could only see suppliers selling hardware. And then in the year after, we could see suppliers selling hardware and software in banking and in security. This year, it is mostly selling artificial intelligence, but this time we’re seeing customers. Before that, there were very few customers and very few leads we could obtain. This year, we have maybe as many customers as suppliers.”

“Why do you think people became more receptive to this kind of service and this technology?”

“There is a convergence of everybody, meaning: users, banks, and everyone else in the ecosystem, looking to cooperate instead of everybody working on his or her island and finding out that convergence is preferable to divergence. So, there’s a certain maturity that now exists.

And then Seamless itself, because it’s proven to be there…resilient, open, and growing, so it created an inclusive space to let everybody in.”

“What are the future plans you have for the GCC market, particularly in light of the heavy banking regulations?”

“The good thing is that the regulation is converging. All the GCC States have had the intention to move toward open banking and it was first applied in Bahrain, followed by Saudi Arabia, and then the others. Now, they are all accepting open banking, which means you can access a bank from an external application instead of each bank having its own application. You can put an application on top and talk to several banks.

So open banking is happening not only in Bahrain now, and the convergence of the laws or the rules was helpful because instead of doing separate integrations or setups for every country in GCC, we can have a single one.”

The Deputy CEO then proceeded, “And also, maybe later on, it’ll act like a common market for them all, which is more regulation but we don’t have anything against that, but because it’s convergent regulations is helpful. And now we have access to more partners, especially in UAE. I think we have the partner we need, from the same school, from the same mindset.”

“What do these partners bring to the table?”

“Licenses. That’s it. They have the license, and they develop their own market, such as savings, for example, which is not our primary target. We want to monetize their license. We can use it and provide other fintech services. If somebody wants savings, we direct the savings back to our partners.”

“On to the technical side. When you talk about MyMonty and MontyPay, can we say these two entities develop their own technologies? To give yourself the advantage? To deliver something new to the market that no one else has?

Or do you take a service, you optimize it, you work around it, and then you deliver it to the market,” I raised the query.

“Well, both actually. So, with MontyPay, we took a white label, and this is our main engine. It’s not the technology that we own, and we add AI, dashboards, and the analytics part on top of it.

For MyMonty, we started using a white label and then we built our own.

So, our long-term goal is to own our own technology.”

“To rent?” I asked.

“Yes, we rent it and sell it, because we believe that if you don’t sell it to somebody, this customer that we do not provide to will buy it from elsewhere.”

“Or they’ll work on creating it and then become a competitor.” I assumed.

“No, no, let them come and compete with us. So, we give him or her the technology and tell them, okay, come and compete with us. Because we don’t have a monopoly, because they’re going to compete with us anyhow. Either they buy from us or buy from somebody else. So they buy from us, we get some return out of it instead of just competition.”

“Tell me what new technologies you’re planning or promoting?”

“We’re going to build telecom equipment. Just like Ericsson, Huawei, and Nokia. Antennae, software and hardware. To be deployed anywhere. And we are going to test them in Gambia and start commercializing them.”

The chat was at an end, and after thanking Cesar and going in search of a cup of coffee, I was left with a feeling about the scale and ambition of the group’s plans. They were perfectly in sync with the optimism and energy that has fueled Seamless since its inception.

Much like its host city, Dubai.

Inside Telecom provides you with an extensive list of content covering all aspects of the tech industry. Keep an eye on our Interviews to stay informed and up-to-date with our daily articles.