Investors pulled more money from funds marketed as “sustainable” than they added for the first time in more than a decade in 2022, hit by fallout from the Ukraine war, tumbling financial markets and a political backlash against the industry.

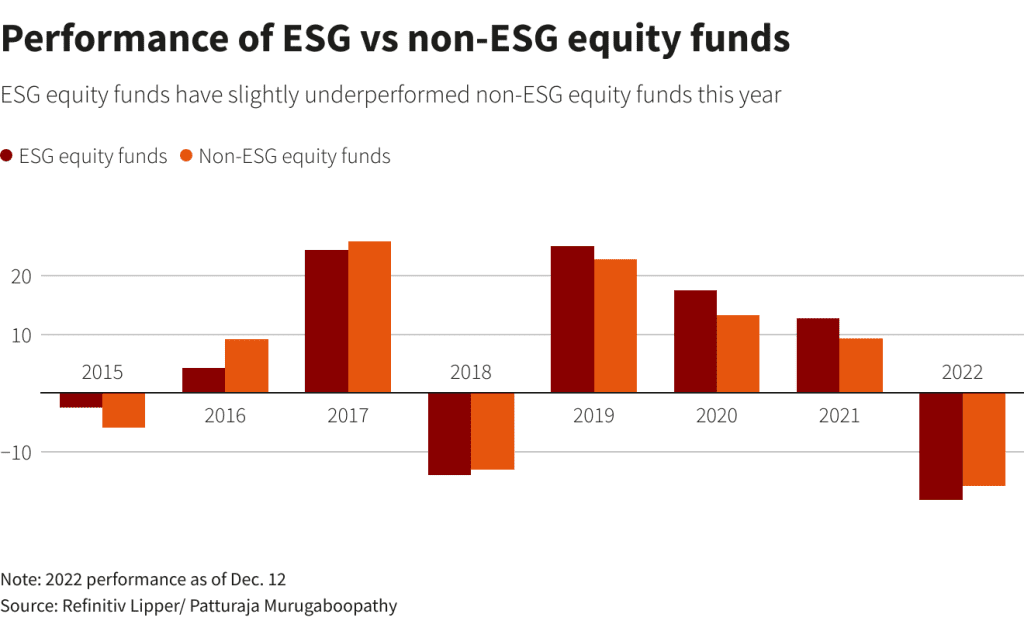

The funds, which reflect a range of environmental, social and governance (ESG) issues, are also set to lag the performance of non-ESG funds for the first time in five years, data shows, after the fossil fuel shares they typically shun soared.

Combined with a drop in corporate fundraising through sustainable bonds, 2022 has been a tough year and 2023 may prove difficult too, given market volatility and investors’ need to preserve capital.

“There has been a lot of questioning of ESG this past year,” said Marie Niemczyk, Head of ESG Client Portfolio Management at asset manager Candia, citing market turbulence, some political hostility towards the sector in the United States and inflation, which has hit demand for riskier assets.

“They (ESG funds) are subject to the same market movements,” she added.

WITHDRAWING

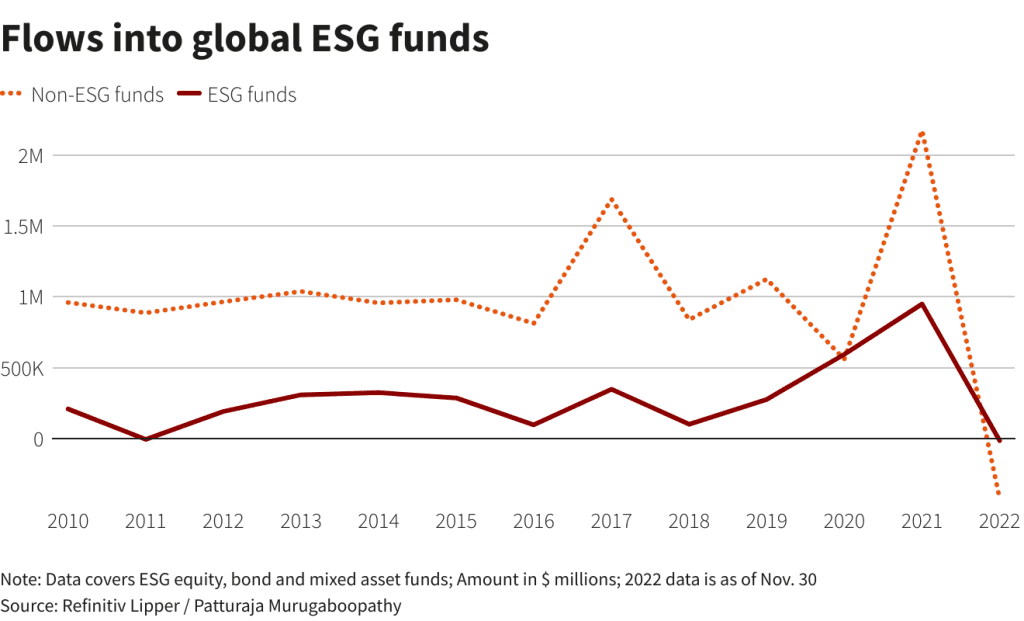

Investors have withdrawn a net $13.2 billion from ESG stock, bond and mixed-asset funds this year to end-November, based on Refining Lipper data, the first net outflow since 2011. It follows years of rising net inflows.

However, non-ESG funds have also suffered withdrawals, losing $420 billion in the first 11 months of 2022, the data shows.

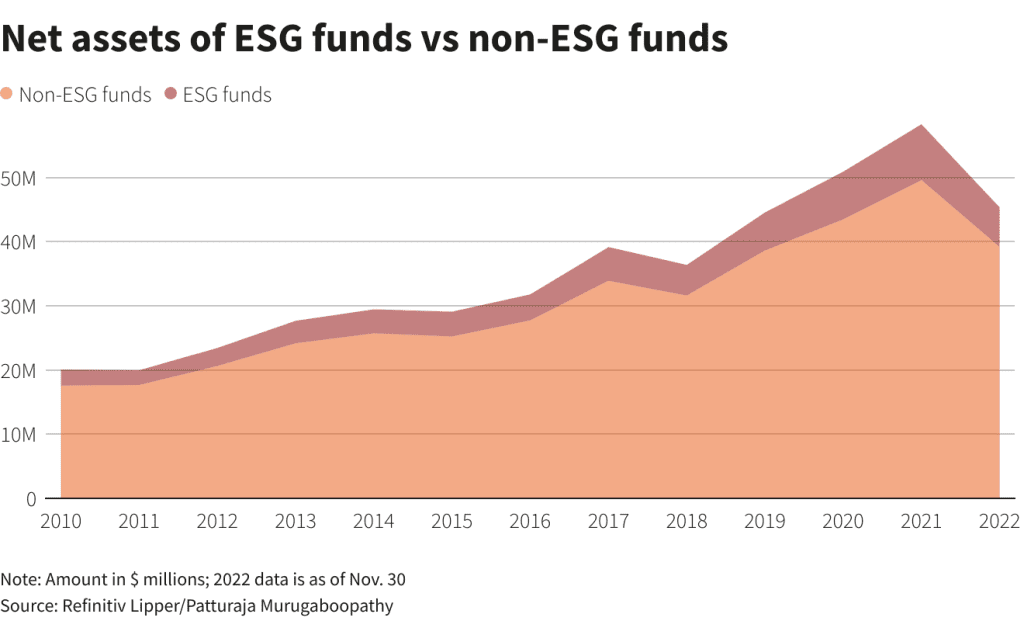

Total net assets managed in ESG funds are down 29% so far in 2022, against a 21% drop in non-ESG fund assets, driven by investors pulling cash and the decline in asset values as markets tumbled.

UNDERPERFORMING

After several years of outperform – thanks partly to large holdings of U.S. technology stocks – ESG equity funds, which make up the bulk of assets in the sector, have fallen back to earth.

ESG equity funds have lost 18% to end-November, versus a 15.8% fall in non-ego equity funds, based on Refining Lipper data.

The MSCI World Index and the MSCI World ESG Leaders Index are both down nearly 20% this year to Dec. 16.

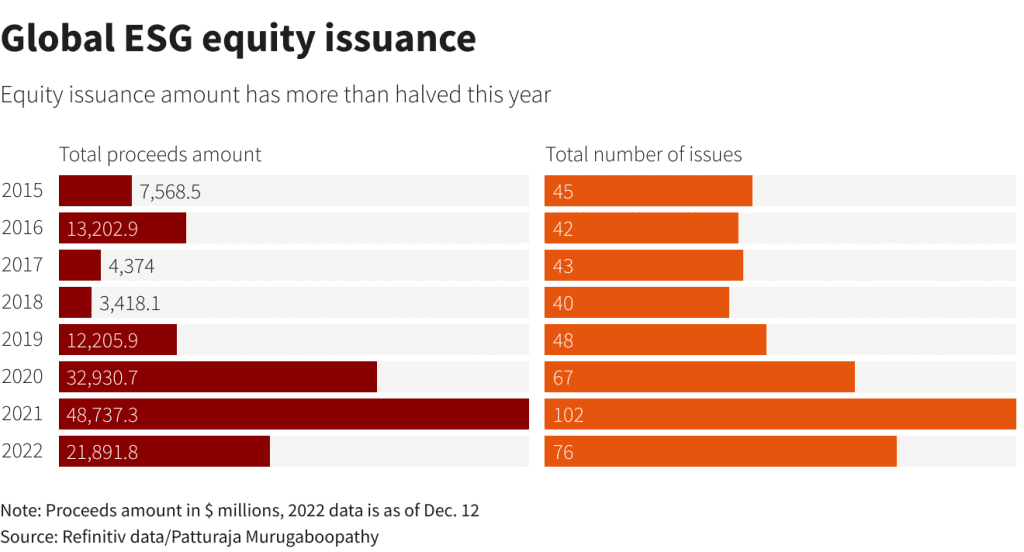

CAPITAL RAISING SLOWS

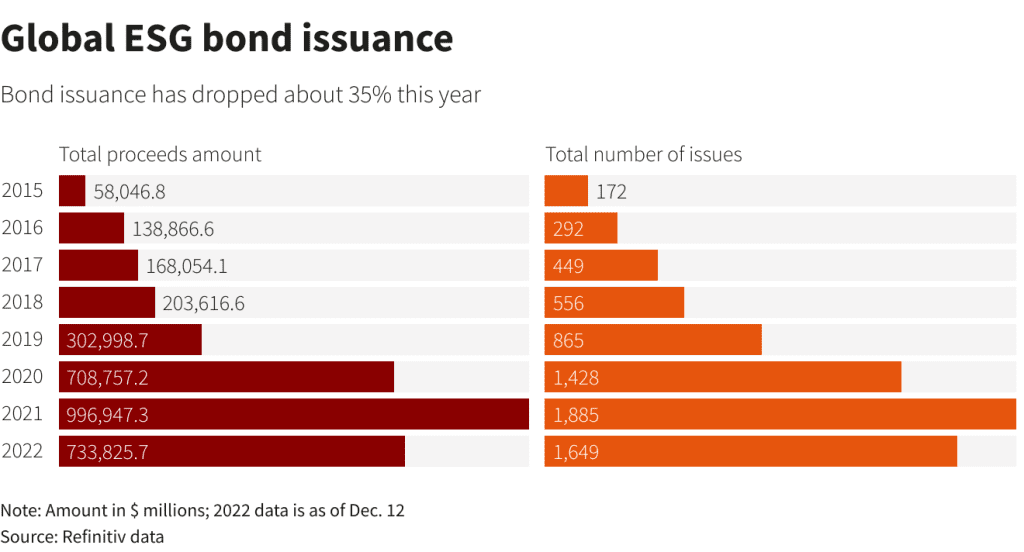

The amount of cash companies have raised through sustainable bonds such as green bonds, as well the volume of capital firms in sustainable industries have raised on debt or equity capital markets has fallen in 2022 with the economic outlook worsening.

Industries that Refining regards as sustainable include renewable energy, electric vehicles and organic farming.

LONDON (Reuters)

Inside Telecom provides you with an extensive list of content covering all aspects of the Tech industry. Keep an eye on our Breaking News section to stay informed and updated with our daily articles.