Chinese chip design company Unisoc (Shanghai) Technologies Co is seeking to raise 10 billion yuan ($1.5 billion) in a new funding round that will value the firm at about 70 billion yuan ($10.3 billion), three people with knowledge of the deal told Reuters.

Unisoc has approached several state-backed investment funds for the round, tapping increased local investor interest in China’s domestic chip industry, which is gearing up to be more self-sufficient in the face of U.S. pressure, the people said.

One of the people said that the company aims to reach a shortlist of investors by mid-March, and close the round by the end of June on the way to an eventual domestic listing. The sources all declined to be identified as the information is confidential.The company announced it was raising funds last week, with its board secretary, Jia Shaoxu, saying it would use the funds to enhance its technology and product competitiveness, according to its official WeChat account. It did not disclose the amount.

The fundraising comes as China ramps up efforts to boost its domestic chip sector and Chinese President Xi Jinping urges the country to become more technologically self-sufficient.

Washington has put in place a slew of export controls to slow Beijing’s technological and military advances, including measures to curb China’s access to U.S. chipmaking tools and cut it off from certain chips made anywhere in the world with U.S. equipment.

Chinese companies the Biden administration has targeted include the country’s largest chip maker, Semiconductor Manufacturing International Corp, and memory chip manufacturer Yangtze Memory Technologies Co Ltd (YMTC).

Unisoc is controlled by private equity firm Wise Road Capital, which took over the company in 2022 after Tsinghua Unigroup, its former parent company, faced bankruptcy.

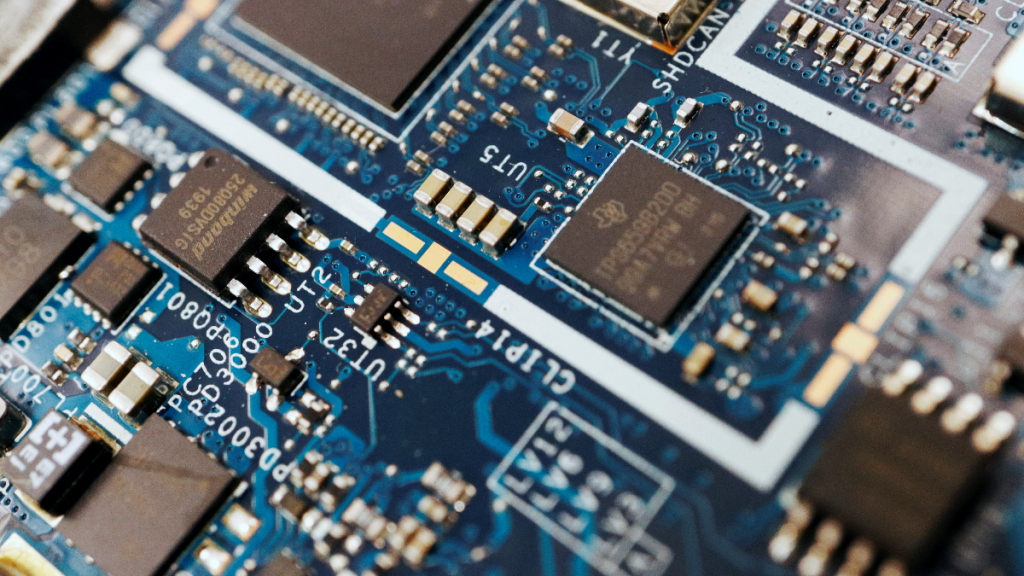

Based in Shanghai, Unisoc competes against Qualcomm Inc, MediaTek Inc, and Samsung Electronics Co Ltd, and its product portfolio includes mobile processors for smartphones, as well as simpler chips for internet-connected devices.

It does business in 133 countries, according to its website. Although its sales are low compared with those of its rivals, the company’s share of global market for mobile processors increased to roughly 10% by 2022, according to Counterpoint Research.

In its statement from Feb. 8, it added it had reached revenue of 14 billion yuan in 2022. A statement in July 2022 said it had revenue of 11.7 billion yuan in 2021.

In addition to Wise Road, the company’s shareholders also include also China’s state-backed investment fund for chips (known as “the Big Fund”), which has a 13% stake in the firm, as well as Intel Capital, which retains an 11% stake in the company via an investment from 2014.

HONG KONG/SHANGHAI (Reuters)

Inside Telecom provides you with an extensive list of content covering all aspects of the Tech industry. Keep an eye on our News section to stay informed and updated with our daily articles.