Authenticity in online persona is a crucial concern as remote working becomes the norm. _______________________ Taking you on a walk through my experience during the pandemic, we all handled it differently; each person has their own version of the story. As I got to know my new classmates and professors online, I found myself connecting […]

5G

Xenotransplantation ethics raises concerns due to the potential impact it could have on the ethical treatment of animals and the potential harm caused by this practice. The potential benefits of xenotransplantation, which involves the transplantation of organs or tissues from one species to another. ———- The field of medicine is rapidly changing with new technological […]

The potential benefits and risks associated with the use of Advanced AI systems in decision-making processes. Imagine you live in a world where decisions about your job, your finances, and even your freedom, are made by machines. These machines, powered by artificial intelligence (AI), can learn, and make decisions without human intervention. But can we […]

The tech and media industry has been transformed by technology, making it easier to access news and information through digital platforms. Despite all that, concerns about data and the role of journalists in the news industry have arisen. Have you ever wondered how technology has changed the media industry? From print newspapers to online news […]

This article discusses the motivations behind the push for nuclear power, despite its significant risks and dangers. While nuclear power is viewed as a promising source of clean, safe, and future of sustainable energy, nuclear fusion remains a controversial technology. Have you ever wondered why, despite its dangers and risks, nuclear power continues to be […]

The impact of Twitter’s blue check verification on social media marketing has been significant: Looking back, social media was a space for casual conversations and sharing updates with friends and family. But as these platforms grew and businesses recognized the potential to reach customers through said channels, marketing on social media became a science of […]

Musk’s investments in several industries demonstrate his commitment to shaping the future of technology and science. Elon Musk, the CEO of Tesla and SpaceX, has been in the news lately due to the significant drop in his net worth. In 2021 Musk’s net worth fell by $27 billion in just one week, according to Forbes, […]

On Tuesday, the UK government revealed its intention to create new legislation that would limit the ability of big tech like Amazon, Facebook, and Google to stifle competition within the digital marketplace. The UK government’s proposed law aims to not only enhance consumer protection but also regulate big tech companies to prevent them from suppressing […]

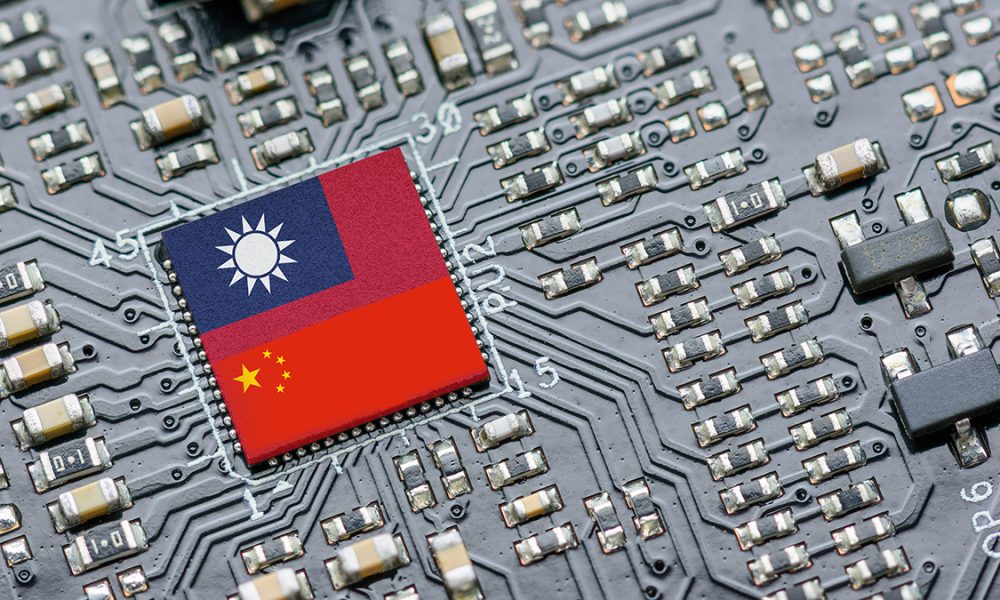

The tech industry has become a battleground in the ongoing conflict between Taiwan and China. China has openly admitted that they are on a fight with Taiwan, whether they like it or not. While the country is working to maintain its technological edge, China seems willing to engage in self-defeating military adventures to prevent the […]

After clinching large deals with telecom operators for 5G equipment, global telecom infrastructure company Ericsson plans to expand its production capacity in India. The expansion plan would collaborate with a local vendor and operate from the latter’s Pune location. It is all part of a well-structured plan for Ericsson to further its global presence. The […]