The world’s largest battery maker CATL and its rivals in China were put on notice this week with a message from the top.

When Chinese President Xi Jinping said he was “both pleased and concerned” about CATL’s electric vehicle (EV) battery dominance, industry executives and regulators heard a caution to be ready to throttle back expansion to keep the current boom from collapsing in a bust of overcapacity.

Xi’s remarks, made in response to a presentation by CATL’s chairman Robin Zeng on the sidelines of China’s annual parliament on Monday, showed CATL has drawn the attention of top Chinese officials. Since last year, CATL’s customers have complained about its market position and the company itself has warned about the risks of the industry expanding too quickly.

Three battery industry executives – including two at CATL – and two people close to regulators working with the industry told Reuters they understood Xi’s remarks as a warning to both the company and the wider battery industry.

One of the five, a senior manager at CATL, who like others asked not to be named because of the sensitivity of the matter, said Xi’s remarks were concerning for the whole industry.

“Pressure is being imposed on all parties,” he said, adding that “even if the government steps on the brake, CATL’s position within the industry won’t be shaken”.

Xi was quoted by Xinhua as saying regulation had a place to ensure that emerging industries like battery production developed in a “steady and prudent manner” to avoid “a boom and a headlong rush that would dissipate in the end”.

CATL did not immediately respond to a request for comment.

Government scrutiny of CATL and its smaller rivals, which represent 60% of global battery supply, would mark a speedbump for an industry that has been more accustomed to benefitting from subsidies.

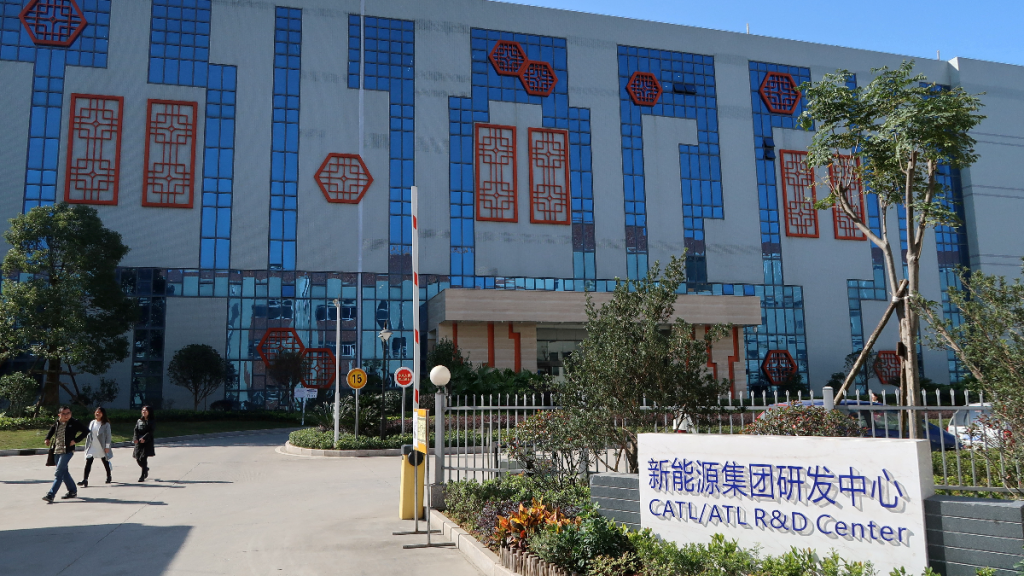

Ningde, Fujian-based CATL, which is expanding in Germany and the United States, controls 37% of the global battery market alone, more than the next three suppliers combined. Its cell-to-pack technology has provided automakers like Tesla with less-expensive iron phosphate lithium-ion batteries.

Consultant Rystad Energy estimates that battery production capacity in China will reach 1,338 gigawatt hours (GWh) by year end, up 23%. CATL alone has 542 GWh of capacity online or under construction, enough to power the equivalent of more than 7 million Model Ys.

But EV sales in China have started to slow, prompting CATL to offer discounts to smaller EV makers in China in February in exchange for locking in future orders.

EXCESS CAPACITY RISK

Zeng told investors in May that the recent wave of investment worth billions of dollars in battery production could leave excess capacity as technology evolves. The company, citing supply deals with BMW, Daimler, VW, Ford and Hyundai, told analysts and investors this week that it had been cautious.

“We will adjust capacity construction according to timely evaluations of the market demand,” the company’s executives told analysts after it released its annual earnings on Thursday.

Xi has in recent months voiced support for private businesses to drive growth, but executives in a range of sectors have been watching how and whether those comments will translate into action after a two-year crackdown on industries from education to technology.

While there has been no indication CATL is being targeted by regulators, it has faced pushback from Chinese automakers who have complained about its pricing power in the world’s largest EV market.

In July, at a session attended by hundreds, including industry and local government officials and CATL’s Zeng, the chairman of state-owned Guangzhou Automobile Group Zeng Qinghong shocked the crowd by taking a shot at CATL’s pricing.

“With batteries now taking up 60% of the cost of each vehicle, how am I not actually working for CATL?” he asked.

Others, such as Xpeng and Nio, are finding alternatives to CATL. Privately, some auto executives, who ask not to be named because of ongoing ties to CATL, have echoed the criticism made by GAC’s Zeng.

CATL’s deal to license its battery technology for production at a plant run by Ford Motor Co also faces potential scrutiny and pushback in the United States and China as EV industry competition between the two nations intensifies. Republican Senator Marco Rubio has called for the Biden administration to review the deal.

CATL told investors that the partnership, which it said was based on “commercial considerations” has been moving ahead.

SHANGHAI (Reuters)

Inside Telecom provides you with an extensive list of content covering all aspects of the Tech industry. Keep an eye on our News section to stay informed and updated with our daily articles.