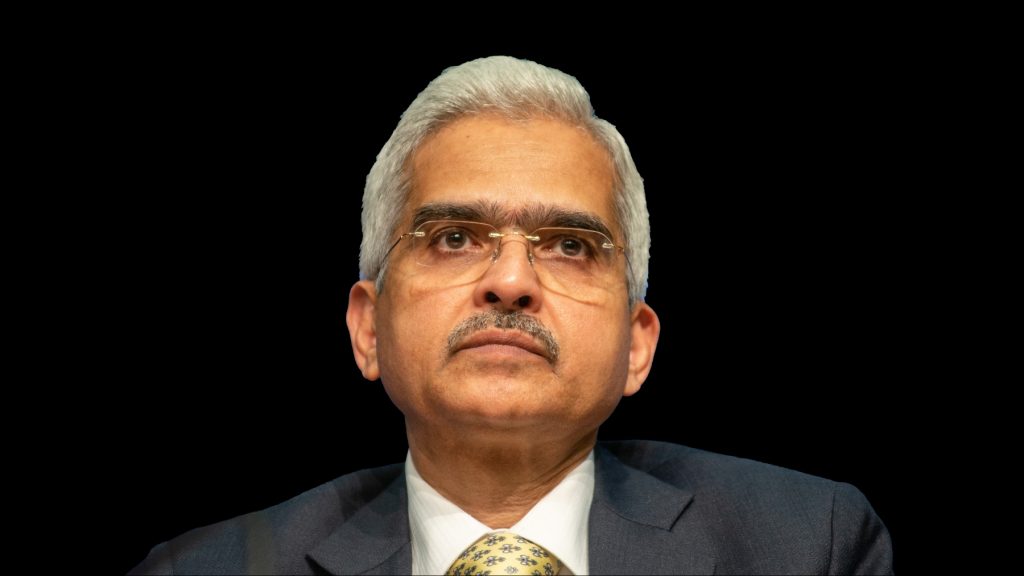

Speaking at an event in New Delhi on Monday, Reserve Bank of India Governor Shaktikanta Das addressed the growing risks accompanying the adoption of AI in baking and machine learning (ML) in global financial services.

The Govenor warned that the dominance of a few technology providers in AI digital banking software could threaten financial stability, accentuating on the need for fiercer risk mitigation practices to address such concerns.

“A heavy reliance on AI can amplify systemic risks, as failures or disruptions in these technologies may trigger widespread repercussions,” Shaktikanta said.

AI in Banks

Financial service providers in India are increasingly adopting AI in banks to focus more on customer experiences, reduce costs, manage risks, and drive growth. Applications such as chatbots and personalized banking services are becoming a safe practice in the banking sector. However, Govenor Shaktikanta warned that even though the integration of AI in banking does offer benefits, in parallel, it also introduces new vulnerabilities of heightened exposures to cyberattacks and data breaches.

Das highlighted the “opacity” of AI systems, which complicates the auditing and interpretation of algorithms influencing lending decisions. Without transparency, the market could face unpredictable outcomes, which may force financial stakeholders to question what the future of AI in banking sector holds.

Das also mentioned in another context that private credit markets are rapidly expanding globally, adding that their limited regulation is one of the main causes for alarm over financial stability.

Govenor Shaktikanta pointed out a worrying aspect application of AI in banking – these markets have never been tested for their resilience during an economic recession which should force the industry’s leaders to question AI ability to withstand financial crises.

As the financial industry continues to adapt with the inclusion of AI in banking, stakeholders must prioritize risk management strategies to pacify potential threats associated with the use of AI in banking and finance. For leaders of the banking sector, such emphasis is on establishing a stable financial system and a promising future of AI in banking.

Inside Telecom provides you with an extensive list of content covering all aspects of the tech industry. Keep an eye on our Tech sections to stay informed and up-to-date with our daily articles.