In 2025, the deep tech startups Europe scene stepped up its game through the creation of new opportunities for innovative hubs and reviewing digital regulation laws to compete against the US and Chinese tech dominance.

Europe currently is home to nearly 19% of these companies, with London, Zurich, Stockholm, and Cambridge are a few of the cities that have become regional innovation clusters, particularly in clean tech, fintech, and quantum computing.

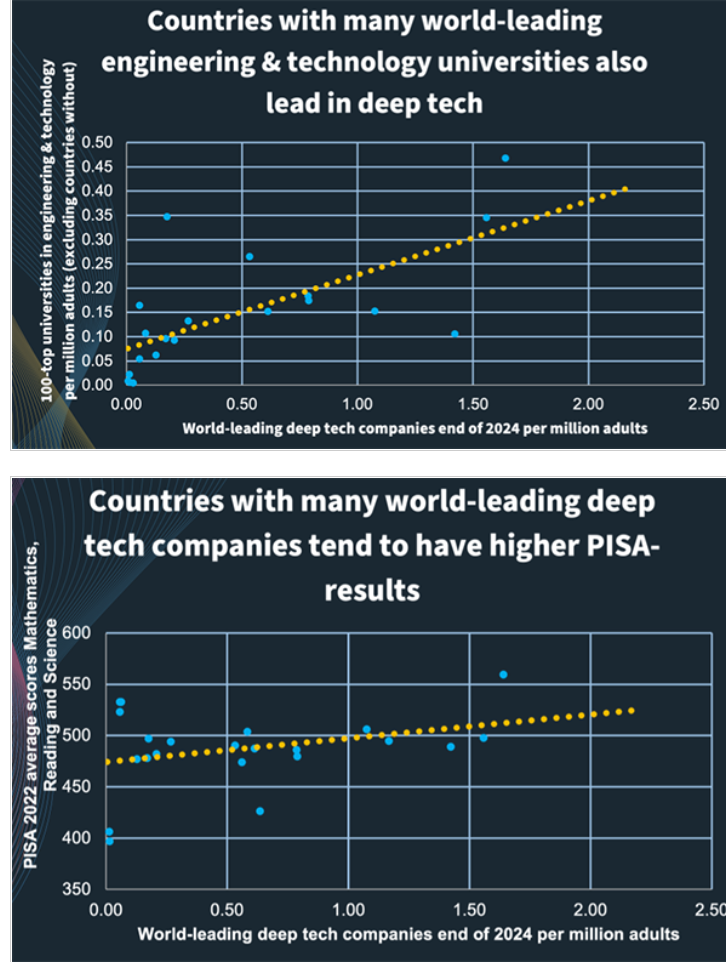

The growth is fueled by strong educational foundations for deep tech funding, and Europe has 31 of the world’s top 100 math and engineering universities, more than the US. Countries like Estonia, Ireland, and Switzerland have education standards without compromising on learning value, driving tech progress.

The US alone has four out of the top five leading the movement of investing in deep tech locations: Santa Clara Valley, Boston, New York, and Los Angeles. London, the fifth, is leading the deep tech startups Europe scene.

As the US gradually becomes more insular and harder for international academics to access, Europe’s openness and competitive pay present it as a desirable partner.

Image Credit: NewGeography

Center for Deep Tech Innovation

Europe has long placed itself as the world’s leader of deep tech investments ethics, home to new digital regulations like the General Data Protection Regulation (GDPR) and the AI Act a push for simplification is hyping controversy.

The European Commission began reviewing key regulations for top deep tech startups and set aside planned rules on AI liability. Officials see that simplifying the framework aids smaller businesses and encourages innovation. Thirteen EU countries are endorsing the move, demanding fewer barriers and less bureaucracy.

Giovanni De Gregorio, Alexandre de Streel, and others caution that deregulation could have hidden effects. Easing deep tech innovation regulations could encourage US tech giants and Chinese tech conglomerates at the cost of Europe’s core values of accountability, data protection, and trust.

Aline Blankertz interprets that the “competitiveness” regulation is not the main obstacle Europe’s issue is the manner it shapes and markets competitiveness.

Former Italian Prime Minister Mario Draghi’s report titles “The future of European competitiveness: Report by Mario Draghi” fueled a debate, claiming that “the EU’s regulatory stance towards tech companies hampers innovation.”

Yet critics argue that the problem falls deeper than policy, arguing it’s about how Europe’s deep tech investors support its tech ambition with its distinct social and economic goals.

With deep tech startups Europe sprinting ahead in fields like quantum computing, ethicality of AI, and green energy, but the continent’s dual ruling as both global innovator and scrutinizing tech regulator is somewhat of a paradox for those looking in.

According to McKinsey’s data, the EU birthed 25% of the world’s top AI ethics startups in 2024, and according to CB Insights, Europe’s share of unicorns of 7% still trails the US – which stands at 48%, and China’s 28%.

“We don’t need fewer guardrails, we need smarter ones,” French AI startup Mistral’s CEO, Arthur Mensch, told Le Monde.

With all that in mind, can Europe refine its approach without sacrificing its core advantage? An advantage based on reputation for trustworthy and privacy-based technology.

Inside Telecom provides you with an extensive list of content covering all aspects of the tech industry. Keep an eye on our Tech sections to stay informed and up-to-date with our daily articles.