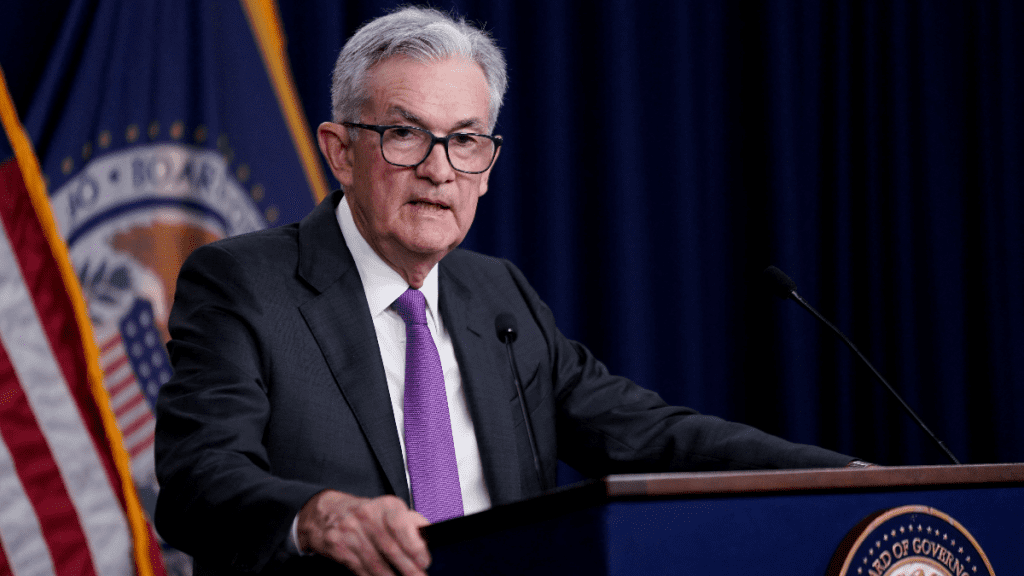

WASHINGTON – U.S. Federal Reserve Chair Jerome Powell said on Wednesday the central bank’s staff no longer forecasts a U.S. recession, and “we do have a shot” for inflation to return to target without high levels of job losses.

Powell told a news conference after the Fed’s latest interest-rate hike that there was “a lot left to go to” see such a soft landing.

“So the staff now has a noticeable slowdown in growth starting later this year in the forecast, but given the resilience of the economy recently, they are no longer forecasting a recession,” he said.

Fed staff last November introduced the notion that a recession might be “almost as likely” as their baseline outlook at the time for below-trend growth, minutes of Fed meetings show. In March, on the heels of the banking sector upheaval that had just been triggered by the collapse of Silicon Valley Bank earlier that month, they shifted to outright forecasting “a mild recession” later this year.

The shift by staff to a less pessimistic baseline outcome for the economy dovetails with outlook upgrades by a number of private-sector economists in recent weeks who have done the same in acknowledgment of the economy’s resilience in the face of Fed 5.25 percentage points of rate increases since March 2022.

Many who had placed a low probability on the Fed achieving a “soft landing” now see that as the likelier outcome than recession.

Indeed, the consensus estimate among economists polled by Reuters is that Thursday’s first reading of gross domestic product for the April-through-June period will show output grew at a 1.8% annualized rate, more or less on par with the 2% rate logged in the first three months of the year.

Fed policymakers themselves slightly upgraded their assessment of activity alongside their rate hike decision on Wednesday. They described recent activity as indicating a “moderate” rate of growth, whereas in policy statements dating back to last September they referred to activity growth as “modest.”

Inside Telecom provides you with an extensive list of content covering all aspects of the Tech industry. Keep an eye on our News section to stay informed and updated with our daily articles.