Citing an improved supply of automotive computer chips, General Motors raised its financial guidance on Wednesday and said it expects to return to a normal production rate by the end of next year.

Chief Financial Officer Paul Jacobson told investors on a virtual chat with Credit Suisse that the company has seen improvement in the fourth quarter on costs and sales volume as demand for its vehicles remains strong.

Nearly all automakers, including GM, have been hit by a global semiconductor shortage, which began late last year when chipmakers shifted production to consumer electronics after auto plants were closed due to the pandemic. When the auto plants came back, chip makers didn’t shift production back to auto chips, which unlike chips for computers and games, have to withstand extreme temperatures and rattling on the roads.

Jacobson said GM now sees pretax earnings for this year of around $14 billion, up from previous guidance of $11.5 billion to $13 billion. Net income for the year is expected to be around $10 billion, GM said in a regulatory filing.

“We’ve experienced a little bit of favorability on cost, and volumes (sales to dealers) are trending higher primarily on chip availability,” Jacobson said.

Jacobson said he expects the first three months of next year to be similar to this year’s fourth quarter, with improvement in the second half of 2022. He said there are “winds of caution” with the omicron variant of the coronavirus now appearing in the U.S.

Most automaker stocks rose in late-day trading Wednesday on news that the chip shorage may be easing. Shares of GM were up 1.3% to $58.60.

Sweden’s Volvo Cars made a forecast similar to GM’s when it announced third-quarter earnings on Tuesday. The automaker said chip supplies improved in the fourth quarter, but it expects the shortage to continue into 2022.

Phil Amsrud, senior principal analyst for IHS Markit who studies the chip market, said that’s consistent with his forecast of gradual improvement through 2022. “We’re expecting supply to be better in the second half of ’22 than the first,” he said. “We are seeing some indications of improvement but we’re also seeing areas that continue to be tight.”

Automakers, he said, have gotten better at managing lower chip supplies, keeping factories open on one shift rather than going flat-out and hoping for chip shipments to resume.

Demand for chips is still high, and automotive is still competing with consumer electronics and other industries.

The bottleneck continues to be high demand for chips that’s outstripping production capacity. Chip makers and others in the supply chain still are reluctant to invest in new factories for fear that the demand is artificially high, Amsrud said.

Earlier Wednesday, GM announced that it is forming a joint venture with Posco Chemical of South Korea to build a North American battery materials plant as it brings more steps in the electric vehicle supply chain under its umbrella.

The Detroit automaker said Wednesday that details of the venture are still being worked out, including investment amounts and the plant location. GM said the factory will supply materials to make cathodes, the energy center of a battery that amounts to 40% of the cost.

The plant will employ hundreds of people and will start making materials in 2024, said Doug Parks, GM’s global product development and supply chain head.

The plant will supply four North American battery cell factories that GM plans to build.

“Scaling battery production is central to our strategy to drive mass adoption of EVs,” Parks told reporters Wednesday. “I think this helps to solidify the supply chain and add security to it.”

Automakers are racing to line up suppliers for scarce battery materials and components in anticipation of a widespread shift from internal combustion vehicles to those powered by electricity.

Auto industry executives polled by KPMG International say they expect more than half of U.S. new vehicle sales to be battery powered by 2030.

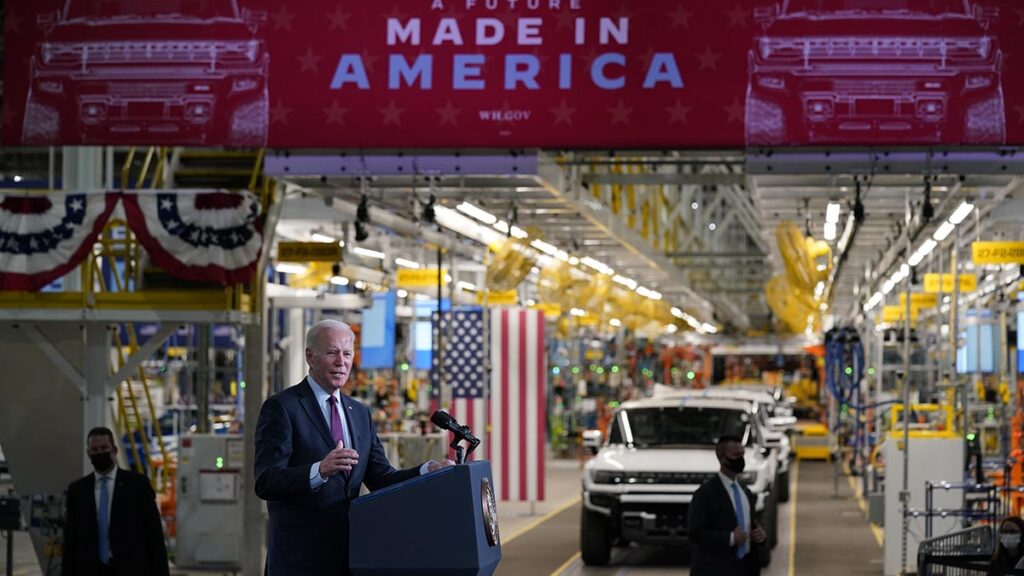

GM plans to build 30 electric vehicles globally by 2025 and says it will spend $35 billion between 2020 and 2025 on electric and autonomous vehicles.

At present, GM isn’t selling any electric vehicles. It’s building pre-production versions of the GMC Hummer EV which will go on sale soon. But it has had to stop selling the Chevrolet Bolt small SUV and hatchback due to a recall over battery fires.

Parks said the cathode materials plant should help GM reduce battery costs. He said the company plans to roll out a small Chevrolet crossover SUV for about $30,000, and another SUV coming at an even lower price.

The new plant will make materials for GM’s new Ultium battery chemistry, using nickel, cobalt, manganese and aluminum, Parks said. A cathode is the negative terminal where current leaves a battery,

DETROIT (AP)