Nvidia’s strong growth forecast for the first quarter on Wednesday signaled that booming demand for its artificial intelligence chips was intact, and the company said orders for its new Blackwell semiconductors were “amazing.”

The company’s forecast helps allay doubts around a slowdown in spending on its hardware that emerged last month, following Chinese AI startup DeepSeek’s claims that it had developed AI models rivaling Western counterparts at a fraction of their cost.

Its shares rose, before declining slightly in choppy extended trading, after closing up 3.7% in regular trading. Nvidia is the biggest beneficiary of a rally in AI-linked stocks, with its shares up more than 400% over the last two years.

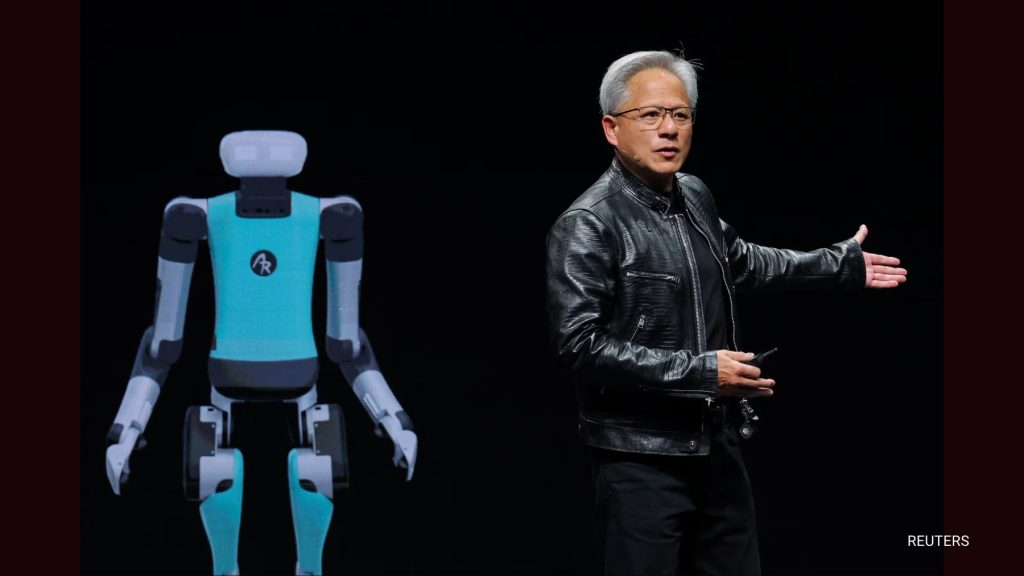

CEO Jensen Huang struck an optimistic note saying “AI is advancing at light speed,” and that “demand for Blackwell is amazing,” in commentary that should bode well for AI-related stocks that have taken a hit in the past week.

“We’ve successfully ramped up the massive-scale production of Blackwell AI supercomputers, achieving billions of dollars in sales in its first quarter,” he said.

Nvidia is undergoing a critical product transition as it moves to a new chip architecture called Blackwell, shifting from selling individual chips to full AI computing systems that integrate graphic chips, processors and networking equipment.

The Santa Clara, California-based company generated $11 billion of revenue from Blackwell-related products in the fourth quarter, roughly 50% of the company’s overall data center revenue.

The company expects total revenue of $43 billion, plus or minus 2% for the first quarter, compared with analysts’ average estimate of $41.78 billion, according to LSEG.

“Unlike previous quarters, there was heightened skepticism going into this report due to concerns about DeepSeek’s efficient model and questions surrounding the Blackwell rollout,” said eMarketer analyst Jacob Bourne. “But the results have removed the doubts.”

The Blackwell ramp-up has been complicated and costly, weighing on the company’s margins, however.

Nvidia on Wednesday forecast first-quarter gross margin slightly below expectations – it will sink to 71%, below the 72.2% forecast by Wall Street, according to data compiled by LSEG. Still, Nvidia’s Chief Financial Officer Colette Kress said on a conference call that Nvidia would return to the mid-70% gross margin range later in the fiscal year as it further increased production of its Blackwell chips, lowering costs.

The AI rally lost some of its steam last month after DeepSeek’s sudden rise, resulting in Nvidia losing $593 billion in market value, the largest one-day loss for any U.S. company. Investors questioned whether demand for AI chips was sustainable and the enormous capital expenses promised by large U.S. tech companies including Microsoft.

Microsoft has earmarked $80 billion for AI in its current fiscal year, while Meta Platforms has pledged as much as $65 billion.

A recent brokerage report suggested that Microsoft has scrapped leases for sizable U.S. data center capacity, suggesting potential oversupply. But Reuters reported on Monday that Chinese companies are ramping up orders for Nvidia’s H20 AI chip due to booming demand for DeepSeek’s low-cost AI model.

“Despite the breakthroughs from DeepSeek, Nvidia’s momentum with Hyperscalers seems to continue,” Third Bridge analyst Lucas Keh said, referring to large cloud-computing companies.

In more positive news for Nvidia, CFO Kress said the Stargate data center project announced last month by U.S. President Donald Trump will use Nvidia’s Spectrum X ethernet for networking. The ethernet products are included in the company’s data center segment.

Nvidia reported adjusted per-share profit of 89 cents, compared with estimates of 84 cents a share. Revenue for the fourth quarter grew 78% to $39.3 billion, beating estimates of $38.04 billion.

Sales in the data-center segment, which accounts for most of Nvidia’s revenue, grew 93% to $35.6 billion in the quarter ended January 26, above estimates of $33.59 billion. The segment had recorded growth of 112% in the prior quarter.

(Reporting by Max A. Cherney and Stephen Nellis in San Francisco, Arsheeya Bajwa in Bengaluru; Editing by Shounak Dasgupta and Rod Nickel)

Inside Telecom provides you with an extensive list of content covering all aspects of the Tech industry. Keep an eye on our News section to stay informed and updated with our daily articles.