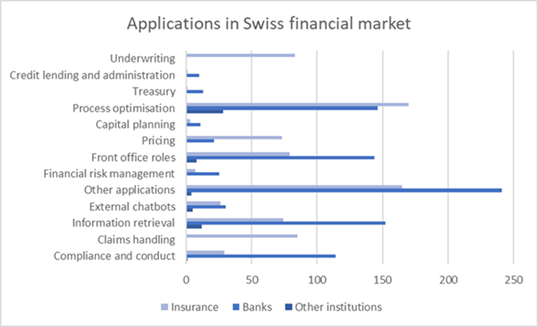

A Swiss Financial Market Supervisory Authority (FINMA) survey revealed that half of Swiss financial institutions now actively use AI – or have pilot programs – with adoption expected to hit new heights as companies currently deploy an average of five AI apps, and nine more in development, pushing AI risk management, according to blog post.

The Swiss regulator’s survey of 400 Swiss banks, insurers, and asset managers from November 2024 till January 2025, found 50% already adopting AI solutions, while another 25% plan adoption within three years.

Switzerland’s financial institutions’ integration of AI risk management tools, alongside customer services and operations is simultaneous with FINMA’s scrutinizing emphasis on establishing strong governance frameworks in the country’s conservative financial sector.

Credit: FINMA

AI Financial Risk Management in Banks

The AI trend is further contributing to dependency on Big Tech providers, with many institutions instead choosing to use external service providers rather than building their own AI tools – a risk addressed in FINMA’s 2024 Risk Monitor.

AI financial risk analysis and management are becoming essential for identifying and preventing issues. As AI adoption widens, financial institutions are mapping out AI risk management to avoid problems, with about 50% developing dedicated plans. They are focusing on robust data protection, cybersecurity, and data management.

“We need to maximize the stability and resilience of the Swiss financial center in an environment with heightened risks,” said FINMA’s CEO, Stefan Walter, during the 2025 Annual Media Conference.

“The following elements are essential for safeguarding the resilience of the supervised institutions, a strong risk culture and governance, robust capital buffers and a solid liquid position,” Walter added.

The continuously growing application of AI in banking risk management shows the necessity of clearly defined governance structures. Companies are more and more looking into AI application to financial risk management, to help optimize the companies’ overall financial risk management processes better.

Switzerland Setting the Bar

To address AI risk management issues, FINMA is resistant on a “same business, same risks, same rules” approach. This means that AI will be placed on an equal base as traditional financial activities. Therefore, AI should be deployed securely and transparently across the Swiss financial market under FINMA’s oversight.

Institutions integrating AI into critical operations or regulatory processes can consult FINMA to ensure compliance. As financial services risk management through AI grows, prioritizing AI risk oversight is key to guarantee stability and integrity.

Moreover, global regulators are also looking towards AI in finance, with the US Treasury expected to publish guidance on AI-based cybersecurity risk and the EU moving ahead with its AI Act. These developments reflect the growing importance of AI regulation and the need for strong frameworks to manage both innovation and security.

AI adoption in Switzerland’s banking sector is growing rapidly. Almost half of its banks are currently applying or piloting AI solutions. This places Switzerland at the forefront of AI in finance and a standard for innovation. As AI takes a greater role in financial services, Switzerland’s strategy can induce other countries to improve their regulation in financial risk management.

Inside Telecom provides you with an extensive list of content covering all aspects of the tech industry. Keep an eye on our Tech sections to stay informed and up-to-date with our daily articles.