On Tuesday, T-Mobile (NASDAQ: TMUS) reaffirmed its $246 billion market valuation for 2025, driven by its 5G strategic expansion, and competitive positioning against industry giants, combining advanced technologies with strategic business approaches.

The telco’s focus on underrepresented markets, including rural and low-income communities, highlights its commitment to bridging digital divides.

Looking at other innovative solutions, Fixed Wireless Access and fiber-optic networks, what the value and price of T-Mobile stock is doing goes beyond competing in the future of the industry; it’s rewriting it. This transformation is part of a larger plan to position itself as an integrated telecom leader in a challenging and opportunistic environment for growth.

Insights of T-Mobile Stock Forecast 2025

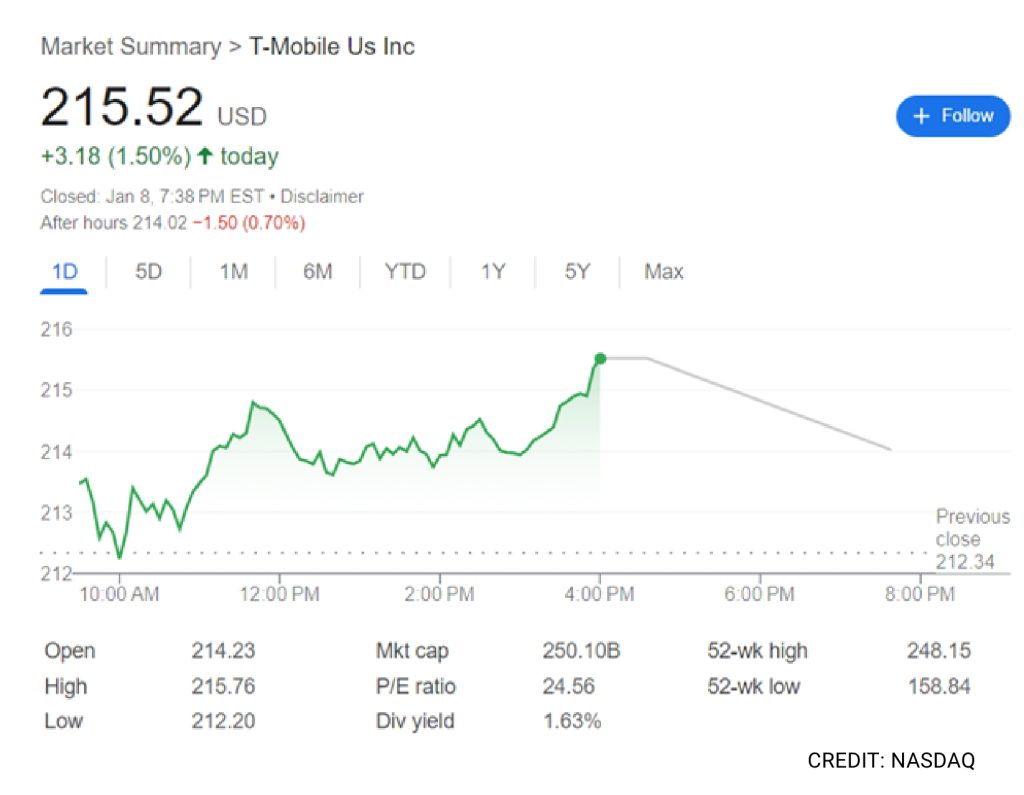

As of January 9, 2025, T-Mobile’s stock price is $215.52 USD, reflecting a +1.50% increase from the previous close.

T-Mobile has maintained its lead through early investments in 5G technology and aggressive pricing. A 2020 merger with Sprint placed it firmly with AT&T and Verizon as part of the “Big Three” of US telecoms. Recent reports show strong subscriber growth, headlined by an 865,000 net increase in postpaid phone users during the quarter, a figure larger than any competitor reported.

Beyond wireless, T-Mobile is expanding both its Fixed Wireless Access (FWA) and fiber internet businesses. The company plans to aggressively expand broadband adoption by deploying 5G, particularly in more disadvantaged parts of the country. Its fiber business is expected to pass 10 million homes by the end of 2030, while FWA is likely to add several million more customers through 2027. Both moves signal ambitions to make T-Mobile a full-service telecom operator.

Analysts have set a 12-month average for the T-Mobile Stock Forecast 2025 price target of $239.65 for T-Mobile, with estimates ranging from $168 to $280, indicating a potential upside of approximately 9.37% from the current stock price.

- T-Mobile Stock: Buy or Sell?

The consensus among 21 stock analysts is a “Strong Buy” rating for T-Mobile, suggesting that analysts believe this stock is likely to perform very well in the near future and significantly outperform the market.

- Is T-Mobile a Good Stock to Buy?

T-Mobile’s strategic investments in 5G technology, successful merger with Sprint, and expansion into broadband services position it favorably in the telecom industry. The company’s strong subscriber growth and positive analyst ratings further support its potential as a solid investment. However, investors should consider recent analyst downgrades citing valuation concerns and the company’s maturing growth rate.

As always, it’s essential to conduct thorough research and consider your financial goals before making investment decisions.

Pressured Challenges

T-Mobile is still facing challenges. Severe aggression on the part of AT&T and Verizon pushes the sale of bundled services such as home internet and streaming. This is a dent on the market share of T-Mobile. According to analysts, the current valuation makes further meaningful stock price gains not likely without sustained outperformance.

Other concerns include pricing competition. To keep growth going, T-Mobile may have to resort to aggressive pricing, which would hurt profit margins. While the expansion of fiber is promising, it’s still in its early days, and one may question the profitability of the same in the long run.

Analyst Outlooks

Analysts remain positive on T-Mobile stock, citing unexploited opportunities in small markets, rural areas, and enterprise customers. The company’s ambitious targets of over $40 billion in EBITDA and $20 billion in free cash flow by 2027 further signal potential growth.

Geoffrey Kendrick, Global Head of Digital Assets Research at Standard Chartered said, “At the forefront of 5G and with strategic investments, T-Mobile is well positioned to be one of the transformative forces in the sector.

Investors will also eagerly await the next investor day from T-Mobile, where management is expected to address the issue of valuation and detail its future growth plans. Challenges notwithstanding, at this point, T-Mobile stock forecast 2025 is a force to be reckoned with in this evolving landscape with its innovation and agility in the market.

Inside Telecom provides you with an extensive list of content covering all aspects of the tech industry. Keep an eye on our Telecom sections to stay informed and up-to-date with our daily articles.