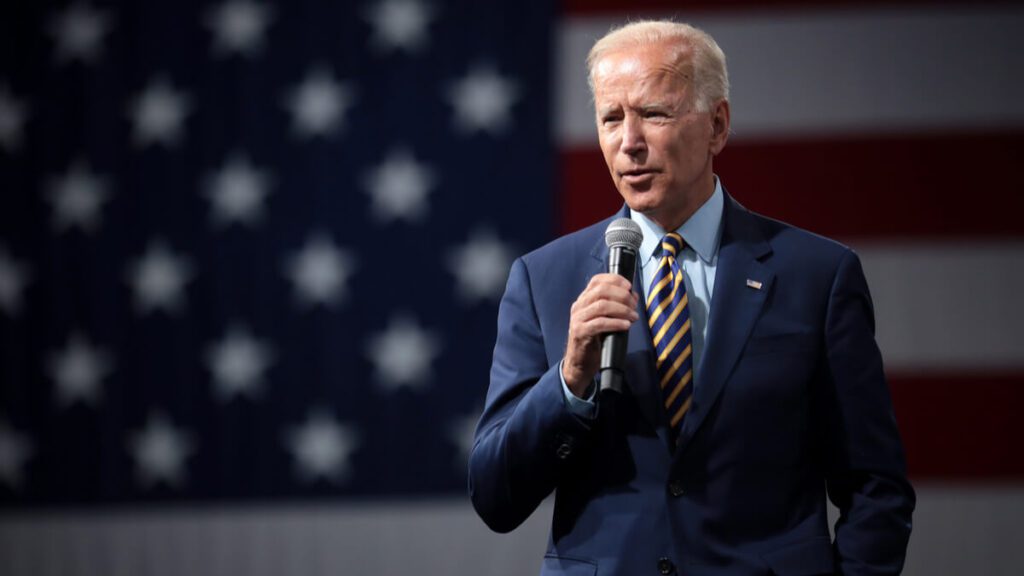

China vehemently objected Friday to U.S. President Joe Biden’s expansion of a list of Chinese companies whose shares are off-limits to American investors because of their purported links to the Chinese military and surveillance.

The White House issued the update late Thursday to an order signed last year by Biden’s predecessor, Donald Trump, that added to antagonisms over trade and technology.

Chinese Foreign Ministry spokesperson Wang Wenbin urged Washington to withdraw the order and “provide Chinese enterprises with a fair and non-discriminatory business and investment environment.”

“China will take necessary measures to resolutely safeguard the legitimate rights and interests of Chinese enterprises,” he said at a regular briefing in Beijing. He did not elaborate.

The executive order takes effect Aug. 2. It is the latest indication that Biden has not softened Washington’s stance on alleged security risks from companies U.S. officials say are linked to the Chinese “military and industrial complex.”

Tariffs on Chinese exports that were imposed under Trump, triggering similar actions from Beijing, mostly remain in place. China’s chief economic envoy, Vice Premier Liu He, and U.S. Treasury Secretary Janet Yellen held their first meeting by video Wednesday, but the two sides gave no indication when negotiations on ending their tariff war might resume.

The revised order from Biden says it is to “ensure that U.S. investments are not supporting Chinese companies that undermine the security or values of the United States and our allies.”

The updated list includes companies that Washington alleges contribute to surveillance of religious and ethnic minorities or to repression and “serious human rights abuses.”

Investors already holding shares in the 59 companies listed have one year to divest from them. Many but not all of the companies on the expanded list already were on a Defense Department blacklist that limits access to American technology and investment. The original list included 31 companies.

It includes telecoms equipment maker Huawei Technologies, which faces various U.S. sanctions, and two of its financial affiliates. It also includes China’s big state-owned telecoms companies and China National Offshore Oil Corp.

Separately, the Commerce Department has put CNOOC, the country’s third-largest national oil company, on an economic blacklist for what it described as “reckless and belligerent actions” in the disputed waters of the South China Sea.

That’s a reference to CNOOC’s involvement in offshore drilling in disputed waters of the South China Sea, where Beijing has overlapping territorial claims with other countries including Vietnam, the Philippines, Brunei and Malaysia, as well as Taiwan.

Semiconductor Manufacturing International Corp., or SMIC, plays a leading role in the ruling party’s effort to reduce reliance on U.S. and other foreign technology by creating Chinese suppliers of processor chips and other components.

The companies added to the list include manufacturers of satellite equipment, integrated circuits, optical components, and satellite communications equipment and software.

Apart from the investment ban, U.S. firms are prohibited from exporting or transferring technology to dozens of Chinese companies unless they have special permission from the government.

Chinese smartphone maker Xiaomi Corp., which overtook Apple Inc. as the world’s No. 3 smartphone maker by sales in the third quarter of 2020, was removed from the earlier investment blacklist after it sued the U.S. government, demanding to be removed and denying it has any links with China’s People’s Liberation Army.

Xiaomi is a Beijing-based company known for its value-for-money smartphones and smart devices.

By ELAINE KURTENBACH AP Business Writer.

Associated Press video producer Liu Zheng in Beijing contributed to this report.