A Lost Case or a Catalyst for a New Digital Banking System?

First National Bank is on the brink of what can only be deemed as an inevitable collapse. The First Republic Bank collapse, resulting in its latest share plummet, a new all-time low drop in share value, can only be seen as a portrait of a fragile banking sector, raising the level of uneasiness about the repercussions that will follow.

Silicon Valley Bank, Credit Swiss, Deutsche Bank, and now, First Republic Bank.

The fragility of these giants highlights what everyone has been thinking of for a while now: concerns about the stability of the US dollar.

Endless Suffering

A little bit of history.

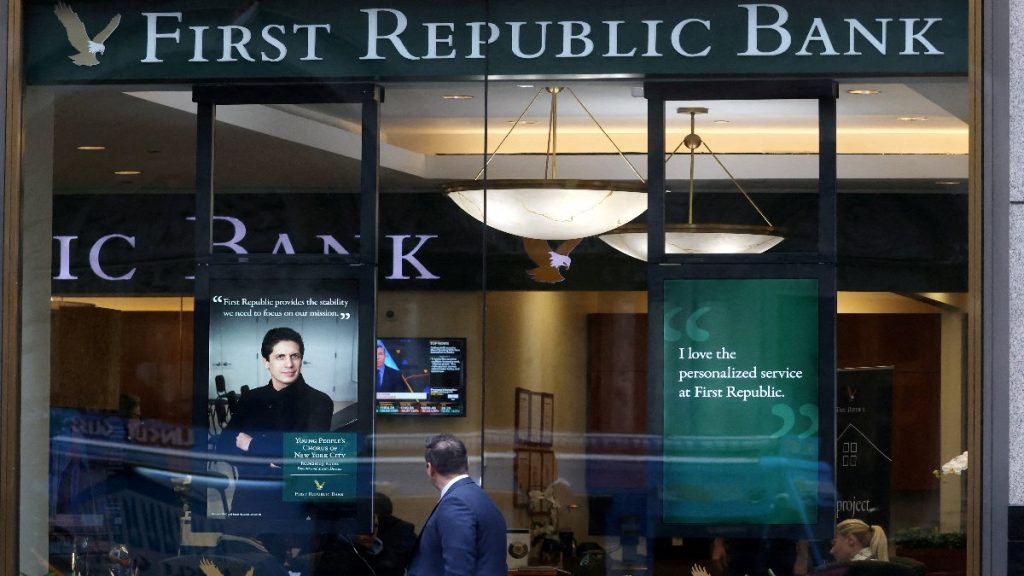

Founded in 1985, the First Republic Bank, while relatively young, holds some significance to the US’s private banking industry. Some of its most prominent achievements in the US banking sector focused on high-net-worth clients as well as delivering personalized services, often not provided by larger banks.

So where does the bank stand at the moment, you ask?

Recent events have unfolded, and the bank suffered a deposit flight, putting it at risk of collapse. This demanded governmental intervention to recoil from any systemic crisis that would not only befall the bank but could very well extend to reach other banks and hit the US banking sectors.

If that is ever to happen, it would mean fracturing the US economy, the stability of the US political system, and of course, the position of the US as the center of all global powers. A puppet master, you may call it.

Just a few weeks ago, the First Republic Bank was pulled from its crisis, rescued from a collapse. But in spite of this, it has failed to recover and now it’s under the spotlight with a risk of declaring bankruptcy.

Allow me to repeat myself just a little bit here.

Silicon Valley Bank, Silicon Valley Bank, Credit Swiss, Deutsche Bank, and now, First Republic Bank. This does not look good.

So, is there a hero in this scenario?

Well, a consortium of investors pumped a whopping $2 billion in an effort to save the bank from its destined demise. Yet, this injection of cash flow did not put a halt to the bank’s distress, and it was unable to stem the ride of deposit flight. Allegedly driven by the bank’s poor management and oversight absence.

With the absence of customer trust, a touch of bad management, and then an endless chain of troubles, the First Republic Bank can only be declared as a lost case at this point.

To some, this may trigger a state of panic. But don’t worry. It’s much bigger than that.

Wider Bank Run? Dollar Fallout? It Cannot Be.

Such events sparked fears among customers, triggering a rush to withdraw their deposits before losing all their savings.

With customers rushing to withdraw, regulators were forced to step in to prevent a full-blown crisis, with the Central Bank closely examining the situation to take the needed measures if needed to guarantee the bank’s failure won’t mushroom into an economic fiasco.

Because, well, a US economic fiasco – triggered by the fall of what was once of the most successful banks in the US – means a risk on the dollar.

CBDC to the Rescue?

The advancement of the Central Bank Digital Currency (CBDC) is linked to the overlapping risks on the US dollar, its stability, and its longevity. Digital assets from the likes of Bitcoin and Ethereum are widely adopted by the public as an alternative to fiat currencies.

Delivering on the promise of a decentralized, transparent, and secure way to transact value without the need for a bank. If we’re talking about currency strength and dominion, this may be the most existential threat the dollar will ever face since its emergence.

The proliferated adoption of cryptocurrencies and the integration of CBDCs by global central banks will pose a threat to the reign of the US dollar as globally adhered to the reserve currency. The collapse of the First Republic Bank, the possibility of the dollar’s fallout, and the rise of cryptocurrency and CBDC are all connected. Now, it’s just a waiting game as we witness the domino effect and the collapse of several banks.

Could this trigger the development of a new, comprehensive, digital banking system? Let’s wait and see.

Inside Telecom provides you with an extensive list of content covering all aspects of the Tech industry. Keep an eye on our Cryptocurrency section to stay informed and updated with our daily articles.