If there’s something that the turn of the decade proved, its that due diligence needs to be taken to the next level.

The pandemic brought businesses across the world to a screeching halt and put the global economy on its knees as waves of lockdown measures forced people to take refuge within their homes.

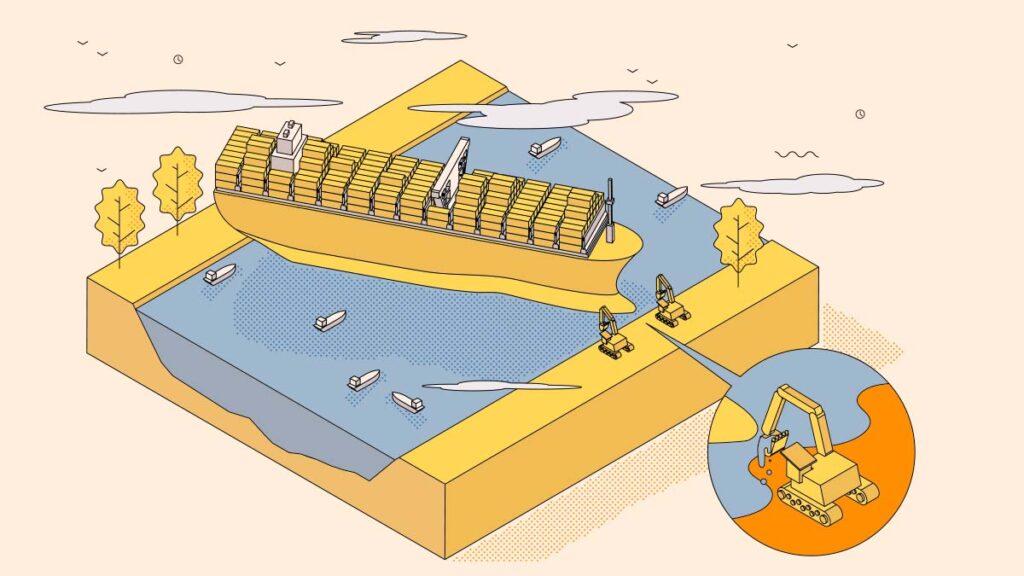

A year later, the now-notorious Ever Given container ship’s crash and halt in the Suez Canal created a traffic jam that not only affected worldwide supply chains but delayed the delivery of vital cargo and fuel from even entering the canal.

Egyptian authorities have already reported that losses from the blockage are estimated at one billion dollars.

While these circumstances and mishaps are categorized as unpredictable, technology is stepping in to help companies prepare for the worst through simulation software, especially on factory floors.

The global simulation software market size is expected to grow from an estimated value of $12.7 billion in 2020 to $26.9 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 13.2 percent from 2020 to 2026, a new report by Research and Markets said.

Some of the world’s largest companies are investing in the technology in hopes of rebounding and refocusing their strategies to pull themselves out of the worldwide recession.

Among them is Hewlett Packard (HP) who used simulation software to model the assembly and test process in the manufacturing of test and measurement products. The inputs for the simulation for one particular product family included a comprehensive mix of data, including cycle times for process stages, machinery failure rates, labor availability, shift patterns and storage capacities.

By varying orders and labor availability, HP’s simulation could determine the most effective set-up of the production line. According to Ian Harrison, QMD at HP, the simulation not only met its objectives but also illustrated the delays and constraints within the process and presented opportunities to reduce and eliminate non-value adding activities.

HP’s simulations echoed the market’s need for the technology for a variety of factors, such as such as a reduction in production expenses and training costs, the use of advanced technologies for simulation and avoiding the production of faulty products to boost the growth of the simulation software market across the globe.

However, complexities in integrating software and increasing data security concerns can hinder the growth.

Professional services segment to grow at a higher CAGR

According to the report by Research and Markets, professional services of simulation software include consulting services, training services, engineering and integration services, and support services. These services play a critical role in the efficient and effective designing and implementation of the simulation software.

Consulting services, such as 3D data visualization and simulation selection, ensure fast and low-risk execution of simulation. Engineering and integration services are the crucial use cases of R&D processes across verticals, such as automobile, mining, and healthcare, the report noted.

Training services are the vital components of simulation services. It helps engineers and product owners understanding the functioning of the product in real-time scenarios.

“This is an essential and critical service for verticals, such as aerospace and defense, ship building and marines, chemicals, and automobiles. Support and maintenance services include technical support, knowledge sharing, and software upgrades,” the study highlighted.

On premise segment to account for a higher market share

On the end-user side, the simulation and analysis technology must be installed or integrated to create virtual environments for designing, PLM, verification, and validation purposes. The on-premises deployment mode is the primary method provided by companies to their employees due to security concerns.

“This helps in maintaining its privacy; however, installing the simulation and analysis technology is a complex process as it has to be integrated with the complex infrastructure of organizations,” Research and Markets explained.

APAC to grow at the highest rate

The simulation software market in the Asia Pacific (APAC) is expected to grow at the highest CAGR during the forecast period, according to the report.

APAC is expected to witness extensive growth opportunities in the manufacturing and IT sectors during the forecast period. The existence of a large population, developing infrastructure and technology and the challenges of many potential accidents are the major factors contributing to the growth of the simulation software market in the region.

“The governments of India and China have been accelerating the manufacturing sector for developing and verifying cars, IT related products and solutions, and defense equipment. High market growth is also anticipated due to technological advancements and utilization of the simulation and analysis technology,” the Research and Markets study elaborated.

The rapid expansion of the domestic market, as well as global enterprises in the region, is also an important factor in the growth of the simulation software market in the region.