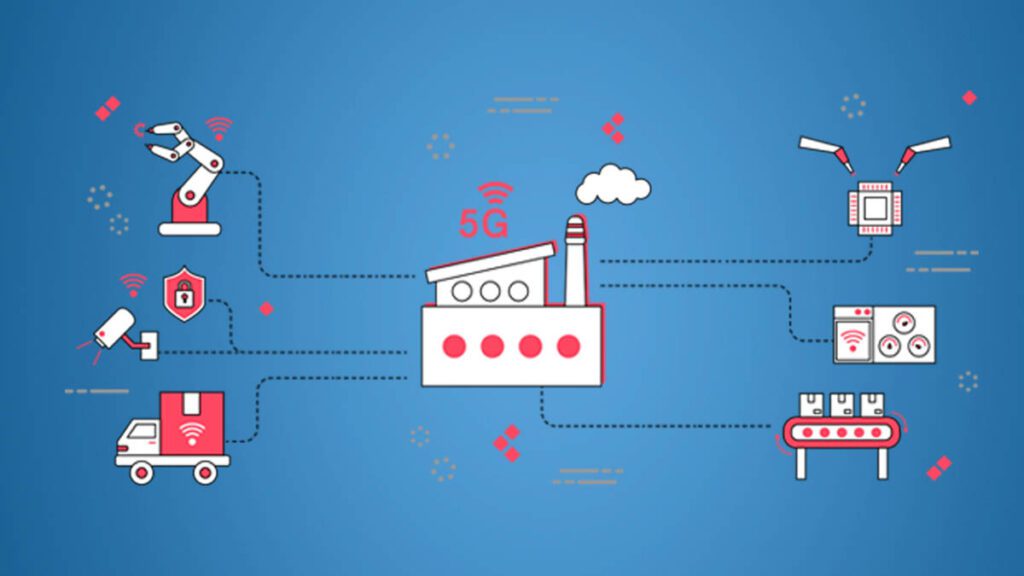

Industrial 5G is set to be a catalyst for unlocking the potential of intelligent industry and accelerating data-driven digital transformation. However, most organizations are yet to realize its true potential. A variety of challenges await industrial organizations as they navigate their 5G roadmaps, and now is the time for telcos to step in and aid manufacturers in achieving their ambitions.

Quite rightly, manufacturing firms widely recognize 5G as the cornerstone of the next generation of Industry 4.0. The combination of high capacity and coverage is making mid-band 5G a particularly attractive choice for a variety of new and transformative industrial use cases.

Recently, we conducted research on 5G in manufacturing and found that 40 percent of industrial organizations expect to roll out 5G at scale at a single site within two years.

Telcos are aware of the opportunity this presents, and they’ve been busy preparing. More than two thirds (68 percent) have already launched commercial 5G services, while the remaining third are at advanced stages of rollout.

However, as is the case with many endeavours, the COVID-19 pandemic has caused significant delays in implementation. This has led to slowed standards development, and delays in spectrum auctions, not to mention the supply chain disruptions, which have impacted telcos’ original equipment manufacturers (OEMs). Yet these challenges have ultimately proven to be short-lived, and now governments and enterprises are accelerating their deployments.

Now that the wheels are in motion for 5G projects, telcos need to step-up and drive these projects forward, and there are several different ways in which they can do so.

More than connectivity

Telcos need to finally unburden themselves from their historical role as mere ‘connectivity providers’. In the 5G world they must act as a solution-driven provider equipped with value-added services — one that is fully aligned with, and is an integral part of, the manufacturers’ digital transformation journeys.

We know that more than half of telcos are aware of these opportunities, but the question remains: how can telcos turbocharge their current offerings with vertical-specific solutions that integrate connectivity, platforms, applications, and devices directly to enterprises?

Private networks and the edge

When industrial organizations plan their 5G initiatives, private 5G networks are the preferred choice, as they provide complete control over their networks and data along with high performance levels.

Our study found that telcos are aligning their enterprise 5G strategy with the demand for private 5G networks. Two-thirds (63 percent) have also launched industrial grade private network solutions to address the private network opportunity and meet the needs of industrial customers.

Verizon, for instance, sees itself as an end-to-end partner for private 5G network implementations, positioning itself to provide services along the customer journey: from helping organizations purchase local 5G spectrum to setting up and managing the private networks on their behalf.

Industry demand for low latency applications and real-time data and analytics continues to grow, with edge computing acting as a key enabler. Because of this, the market for edge computing is estimated to reach USD15.7 billion by 2025.

Take AT&T for example, its on-premises edge portfolio already includes 5G-capable edge computing, and Verizon has also launched a 5G-based edge platform. Telcos therefore must seize the opportunity and incorporate 5G-enabled edge computing services or strategies into their wider business development agenda.

Paint the benefits of 5G

Despite the increasing awareness around the benefits and opportunities presented by 5G, many industrial organizations are still not clear on whether 5G features will translate into practical applications on the ground.

Telcos should take proactive steps to educate industrial customers by demonstrating the impact of 5G in client-specific industrial environments, share real-world results of pilot projects and trials, or even provide a lab like T-Mobile, or create a lightweight platform. Capgemini has also developed 5G Labs in Paris and Mumbai to showcase industrial use cases and manifest new perspectives for industrial clients..

Play an active role

Telcos can play an active role in simplifying manufacturers’ path to 5G adoption and lay a strong foundation for their 5G implementations. By taking a deep dive into customers’ business problems and KPIs, while bringing together viewpoints from stakeholders across the business, telcos can help map out priority areas.

Belgium-based operator Citymesh, for instance, identified more than 100 use cases for one of its clients, based on extensive discussions with stakeholders from across the organization. It has presented a solid starting point for 5G implementations by helping organizations see the full set of possibilities that 5G can offer them before they identify priority areas.

Telcos can also consider simplifying access to vertical-specific solutions by providing them as an as-a-service/ subscription-based model, and onboard suitable partners rapidly to tailor specific industrial 5G use cases. To weather the rapid globalization process, telcos should also develop scalable and global solutions that address the 5G networking needs for a worldwide industrial customer base.

Manufacturers have varying needs, so telcos should offer a portfolio of solutions that address multiple network deployment scenarios, including private or dedicated, hybrid or virtual hybrid, all with clear service level agreements (SLAs). Telcos must also stay focused on security and sustainability to ensure that the networks they help build are resilient and future-proof.

Creating the ecosystem for tomorrow

Industrial executives are now seeking solutions that enable them to not worry about managing a multi-vendor 5G environment. Telcos should therefore focus on building an integrated service offering that combines connectivity with devices, applications, and the security layer – all of which are essential components of an overall 5G solution.

This will require building trusted relationships with a range of ecosystem partners, including cloud providers, edge computing providers, network equipment vendors, hardware providers, and system integrators.

Looking at real life cases, South Korea’s SK Telecom launched a subscription-based smart factory solution for small and medium-sized enterprises (SMEs) that enables organizations to optimize equipment maintenance using 5G-enabled sensors placed on manufacturing equipment.

Only by working together with cloud providers, OEMs, and other partners to build a holistic ecosystem of devices, solutions, and service offerings, can telcos successfully unleash the possibilities of 5G and accelerate adoption in the industrial sector.