In 2021, Ericsson CEO Börje Ekholm claimed that “Europe is too slow with the rollout of 5G”. He also suggested this could impede the success of Europe’s climate goals. While this could be true, the state of Europe’s 5G rollout could have several other knock-on effects. Here, Hamish White, CEO of telecom solution provider Mobilise, explores the reasons why Europe’s 5G rollout is lagging, and why catching up is so important.

According to the European Telecommunications Network Operators Association (ETNO), Europe is falling behind the US and Asia when it comes to 5G development and rollout. Although its 2021 State of Communications report found that the number of Europeans covered by at least one 5G network has doubled, reaching 24 percent in 2020, it’s still not high enough. So, what’s hindering Europe’s 5G rollout?

Delayed spectrum auctions

Spectrum auctions enable governments to sell the rights to transmit signals over specific bands of the electromagnetic spectrum, and are vital in the rollout of 5G bandwidths across the world. Competing applicants will all bid for a spectrum license — the company willing to pay the most for the spectrum wins the license.

But the COVID-19 pandemic has prevented auctions across Europe from going ahead. In August 2020, Ofcom announced the auction spectrum was postponed until January 2021 because of COVID-19 restrictions. It was then pushed back until March 2021.

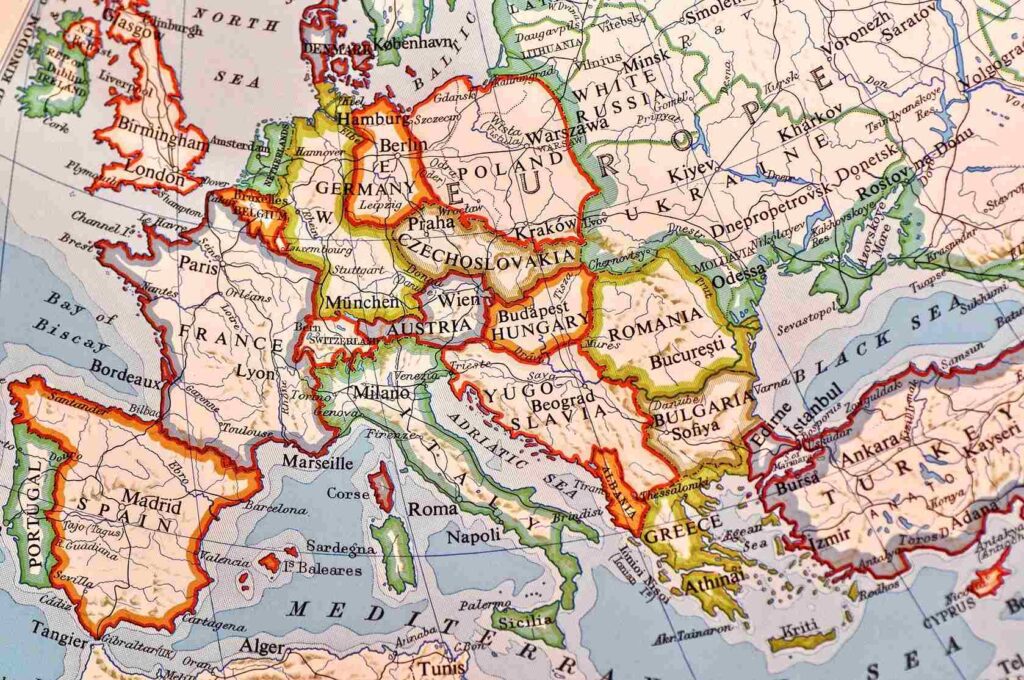

Currently, only 30 percent of the UK can access 5G networks, including Birmingham, Bath and Glasgow. And throughout Europe, there are many inconsistencies as Finland has auctioned all the necessary spectrum bands for 5G, while Poland, Portugal and Belgium are yet to complete any auctions.

The cost associated with these auctions can also impact the speed of 5G’s rollout. Governments can set starting prices so high that operators can’t afford to participate. Furthermore, governments can also inflate prices by limiting how much spectrum is made available, again meaning that fewer operators can afford to take part.

Global chip shortage

The impact of the global semiconductor chip shortage has been felt across industries worldwide including automotive, consumer electronics and appliances — and telecoms.

Like any industry, demand issues have a knock-on effect across the supply chain, and telecoms is no exception. According to the Semiconductor Industry Association, around one third of all semiconductors made are for communications, which includes equipment such as routers and base stations. A shortage of these devices could cause a delay in gear procurements by telcos, slowing down 5G network deployments and expansions.

The real divide

The digital divide refers to the unequal access to communication technologies, which is split into two divisions. The uncovered population lives in an area where there is no mobile network and they cannot connect to the internet, whereas the covered population lives in an area of network availability but cannot access the internet because of a lack of affordability or technology literacy.

There is also a clear gap between economies that can access 5G networks and those that cannot. Around one in four Europeans can connect to a 5G network compared to 76 percent of Americans. But in South Korea, which is leading global 5G rollout, it’s 93 percent.

5G is not just about faster connectivity. It brings many benefits that encourage economies to become more innovative and productive. Wireless technology is no longer just important for consumers and entertainment, it has become critical to how businesses connect employees and how schools educate pupils. And those without reliable network access become further disadvantaged, academically and economically.

Although the uptake of 5G in Europe is out of telcos’ hands, it’s vital to ensure that when the time comes, they can transition to 5G with ease. To support organizations launching 5G services, Mobilise offers its customers the 5GTM — a modular suite of end-to-end support services that help operators to smoothly transition from 4G to 5G. With the 5GTM framework, telcos can have a head start in helping to close the 5G divide.

While the phrase ‘slow and steady wins the race’ may be correct in some cases, it doesn’t apply in the case of Europe’s 5G rollout. It’s obvious that changes must be made if Europe is to catch up with the United States and Asia. Though the delayed spectrum auctions and the global chip shortage is out of telcos’ control, they must do all they can to ensure they support telecoms’ digital transformation and the digital needs of customers.

About Mobilise: Mobilise is a leading provider of SaaS solutions to the telecommunications industry. Focused on delivering highly engaging digital-first service propositions with excellent customer experience, Mobilise has a proven track record, deep industry knowledge and a team of specialists to support clients to building and executing transformational strategies.

Clients range from large corporate organisations with over 100,000 employees to small enterprises with under 20 employees. Mobilise has a deep knowledge of the telecoms business model and our experience includes working with over 40 service providers across eight markets for brands including Virgin, Dixon’s Carphone, Red Bull Mobile, Manx Telecom and Freenet.