The crypto winter that began earlier this year with Russia’s invasion of Ukraine has turned into a disaster with the recent FTX crash. While the ultimate fate of FTX and its creditors is not yet decided completely, it is not all doom and gloom. Telcos may have a significant chance to jump in and take over many areas of the crypto market that were previously controlled by centralized exchanges like FTX, no longer trusted by consumers.

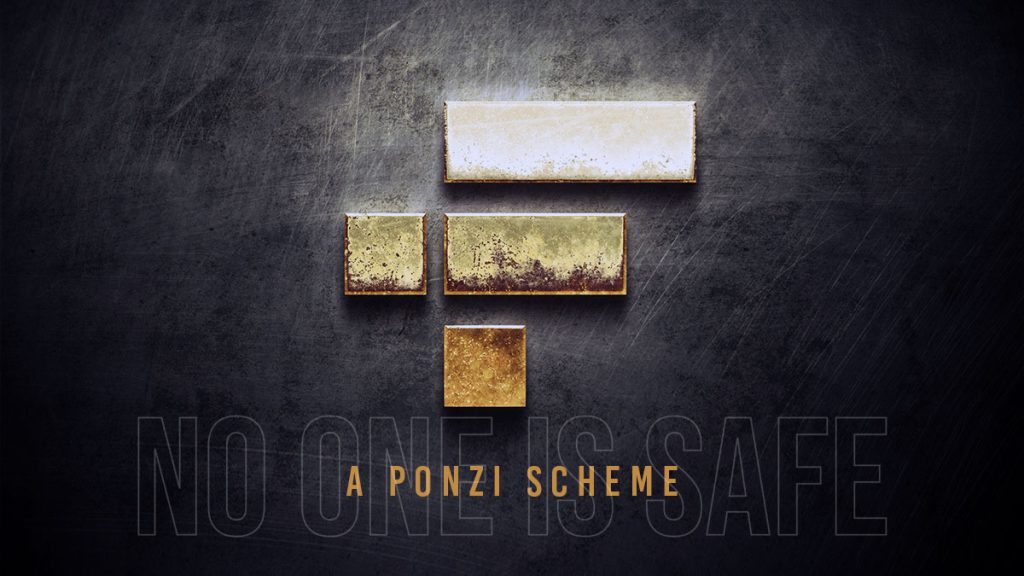

The FTX Crash in a Nutshell

With reports circulating that the fund formed by industry legend Sam Bankman-Fried was unable to pay its creditors, a large sell-off by platform users hastened both the firm’s downfall and a further drop in the value of some of the world’s biggest cryptocurrencies. Bitcoin itself lost 25% of its value in a matter of days, and it is now worth less than $15,000. It was worth $60,000 a year ago.

The FTX Crash has Awoken Consumers

People are reminded of what makes blockchain technology revolutionary, and are focusing their efforts on developing products and solutions that capitalize on its strengths: enabling anyone, everywhere to transfer, store, and manage their money and assets peer to peer.

The world needs a legal framework that protects people while also encouraging innovation. The existing quo of regulation through enforcement must be changed. Policymakers and business leaders may collaborate to establish something like the 1996 Telecommunications Act, which set the circumstances for responsible innovation to thrive.

The period of hero worship centered on crypto entrepreneurs who operate centralized businesses has passed. The fact is that middleware such as FTX does not have to dominate the business. After all, what makes Web3 so appealing is its permissionless and decentralized nature, which means that anyone, anywhere may own digital assets, manage them peer to peer, and have a role in their administration.

There is increased support for organizations who wish to use public blockchains to build in Web3. Many large corporations have spent years experimenting with permissioned blockchains and other closed systems and are now ready to make the switch to Ethereum and other public infrastructure.

In this arena, users still want dependable service providers. Web3’s technical capabilities are not for everyone, and many users are understandably concerned about holding their own assets.

The Silver Lining of the FTX Crash

There is some positive news to emerge from FTX’s demise: The discovery that cryptocurrency may not be the golden hen for inexperienced investors is a welcome development for markets. In market microstructure, these investors are known as “irrational traders,” and they are typically exploited by better-educated traders. Irrational traders have historically had a large influence on pricing, which is undesirable for an efficient market to function. When they are gone, we may have a market that prices crypto assets at their true value.

Because Bitcoin, the most prominent cryptocurrency, lacks a business model, its price (and hence value) is in the eye of the beholder and is constantly set by the intersection of demand and supply. However, the others (Ether 2.0, Cardano, and Solana) should be regarded as utility tokens rather than currency. In this sense, they permit decentralized finance (DeFi) transactions, provide a value for non-fungible tokens (NFTs), and ultimately serve as the money for future Metaverse services.

The good news is that we can begin to regard these tokens as sources of wealth rather than cryptocurrencies in the traditional sense. To give a useful example, we are presently in a scenario comparable to that of just after the internet bubble burst in 2001 when actual internet-based business models could finally emerge.

Despite the fall of FTX, blockchain technology is still alive and well, and it is the basis of many exciting efforts that are altering our financial system and economies. Financial markets, blockchain-based greenhouse gas emission pricing solutions, utility tokens that challenge established internet platforms, smart contracts, and digital assets as personal and commercial financial tools: these are just a few of the applications of the technology that, hopefully, will receive the attention they deserve.

Where Telcos can Step Up

We know that the fall of FTX is not the end of the line for cryptocurrencies and certainly not for blockchain technology. It is just another difficult lesson learned along the lengthy journey of a rapidly developing technology that is establishing itself in the modern marketplace.

Telcos can not only capitalize on the current climate surrounding crypto and blockchain technology but claim a large piece of the market pie by doing what they do best as telcos.

Let’s take a look at some good use cases for telcos in the blockchain revolution listed in this report by Deloitte:

- Reducing Fraud: Fraud detection and prevention remain important concerns for most CSPs, owing to the industry’s annual fraud expenses of more than USD 38 billion11. Given that the telecoms sector has yet to discover a mechanism to successfully and sustainably prevent fraud, blockchain is a strong contender for drastically lowering the cost of fraud, for example, in roaming and identity management. Blockchain has the ability to reduce fraud losses while also lowering the cost of fraud detection programs.

- Identity-as-a-service and Data Management: CSPs may generate new income streams by offering partners identification and authentication as well as data management solutions enabled by blockchain. Through fast and automated processes based on smart contracts, blockchain adoption might drastically minimize roaming fraud while also optimizing ID management.

- 5G enablement: Another example of how blockchain might be used to improve procedures is the introduction of 5G technology. To fulfill the 5G promise of ubiquitous access across different networks, CSPs will need to manage heterogeneous access nodes and diverse access methods. Selecting the shortest access node for each user or machine will be quite challenging in the future. The creation of long-term solutions may benefit from a new generation of access technology selection procedures brought forth by blockchain technology. A new generation of access technology selection processes required for the rollout of 5G networks may be made possible by blockchain technology.

- IoT connectivity: With cost-effective self-managed networks, a blockchain can provide safe and error-free peer-to-peer communication for thousands of IoT devices. Machines in a manufacturing facility, for example, will be able to communicate and verify themselves using the blockchain to drive production processes. Active manual intervention by workers, for example, will be required only if particular machines require servicing based on predictive maintenance signs. Furthermore, the danger of a production shutdown caused by corrupted or hacked devices may be reduced, thanks to the blockchain network’s distributed and consensus-based data authentication.

Closing Thoughts

The foundation of any business is trust. Blockchains enable the trust to be fundamentally built into a technical solution, allowing for smooth collaborations and transactions with very little friction between stakeholders.

However, as we have seen, the technology itself is not enough. Telcos have a part to play as middlemen in preventing people like Sam Bankman-Fried and his ilk from swiping the rug from under unsuspecting customers. Telcos can effectively act as the guardian of people’s virtual wallets just as they have done with their data and personal phone numbers for decades.

Inside Telecom provides you with an extensive list of content covering all aspects of the tech industry. Keep an eye on our Telecoms section to stay informed and up-to-date with our daily articles.